With the implementation of FATCA and the ongoing efforts of the IRS and the Department of Justice to ensure compliance by those with U.S. tax obligations have raised awareness of U.S. tax and information reporting obligations with respect to non-U.S. investments.

This judgment must take into account all facts and circumstances, including all items of evidence, whether in the form of banking or tax-related documentation, third-party statements, or the taxpayer’s own statements.

Because the circumstances of taxpayers with non-U.S. investments vary widely, the IRS offers the following 4 options for addressing previous failures to comply with U.S. tax and information return obligations with respect to those investments:

- Voluntary Disclosure

- Streamlined Disclosure - Non-Resident Taxpayer and Resident U.S. Taxpayer

- Delinquent FBAR Submissions Procedures

- Delinquent International Information Return Submissions Procedures

There are also 5 other options that some taxpayers may consider, which are not as advantageous as the 4 discussed above:

Every taxpayer's case is different, and a number of issues often arise in each case. One such issue is how many years the taxpayer must correct. In many cases, practitioners recommend going back six years, as that is the statute of limitations for criminal tax prosecutions in the US. In other cases, for a variety of reasons, a taxpayer may correct filings for fewer years.

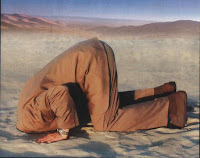

Don't bury your head in the sand hoping your tax problems will go away! Take action NOW while you still have options!

It would behoove taxpayers worldwide, to review their tax-related structures, accounts and holdings, to ascertain whether it would make sense to consider a voluntary disclosure. This is especially the case for valued company management who may have undeclared assets in tax haven countries and for families and individuals about secret accounts or offshore business structures, which may be perceived as abusive.

Want to Know if the OVDP Program is Right for You?

Read more at: Tax Times blog