According to Law360, The IRS has announced six new compliance campaigns focused on issues affecting U.S. nationals' overseas income, capital gains taxes for some pass-through businesses and certain forms of deferred compensation for services.

A statement from the Internal Revenue Service's Large Business and International division didn't include a launch date for the campaigns, but their adoption brings the total number of LB&I compliance initiatives to 59.

The latest campaigns were decided through data analysis by the division, which oversees corporations, subchapter S corporations under the U.S. tax code and partnerships with assets of over $10 million, as well as suggestions from IRS employees, according to the statement.

LB&I said the campaigns would further its goals of improving decisions on which corporate tax returns require scrutiny, identifying potential sources of noncompliance and making efficient use of resources.

Four of the campaigns involve LB&I's regulatory role in the international operations of corporate and individual U.S. taxpayers, namely, transfer pricing and compliance with foreign tax authorities. These campaigns are:

- Post-OVDP, or Offshore Voluntary Disclosure Program, Compliance;

- Expatriation;

- High-Income Nonfilers; and

- U.S. Territories, Erroneous Refundable Credits.

All four efforts will be led by John Cardone, director of withholding and international individual compliance for LB&I.

The two other campaigns are:

- S Corporations' Built-in Gains Tax and

- Section 457A Deferred Compensation Attributable to Services Performed Before Jan. 1, 2009.

The campaign on post-OVDP compliance is meant to provide U.S. taxpayers a way to voluntarily resolve returns deemed noncompliant because of past unreported foreign financial assets and a failure to file foreign-information returns. The IRS last September officially ended the OVDP after nine years of existence, though it said taxpayers would still be able to come forward with noncompliance matters for the next several years.

The IRS said it would address post-OVDP tax noncompliance through soft letters and examinations. In a memo last November, two months after the program's end, the agency detailed a new process for delinquent taxpayers who may wish to avoid criminal prosecution by divulging assets they had willfully failed to report in the past.

The process requires taxpayers to request “pre-clearance” for participation from the IRS Criminal Investigation Division, after which civil examiners determine tax liabilities and penalties. The civil penalties, which may be assessed for fraud or the fraudulent failure to file income tax returns, could be higher than what would have been assessed under the OVDP.

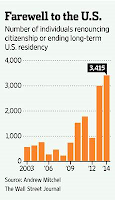

The Expatriation campaign affects U.S. citizens and “long-term residents,” defined as lawful permanent residents in eight out of the past 15 taxable years, who settled abroad on or after June 17, 2008, and may not have met their filing requirements or tax obligations. For such individuals, the IRS said it would address noncompliance through a mix of outreach, soft letters and examinations.

The High-Income Nonfiler campaign will use an examination-based treatment stream to bring into compliance U.S. citizens and resident aliens who have income from abroad but haven't filed returns here.

The fourth international campaign, U.S. Territories, Erroneous Refundable Credits, will use outreach and traditional examinations to bring into compliance bona fide residents of U.S. territories who mistakenly claim refundable tax credits on Form 1040 for individual U.S. filers.

LB&I's operations are also divided among six domestic sectors:

-

communications, technology and media;

-

financial services;

-

heavy manufacturing and pharmaceuticals;

-

natural resources and construction;

-

retail, food, transportation and health care; and

-

global high wealth.

Have an IRS Audit Problem?

Contact the Tax Lawyers at

Marini & Associates, P.A.