U.S. taxpayers who have foreign bank and/or financial accounts should be watching the clock.

The window to Voluntarily Report Foreign Accounts in order to mitigate IRS Penalties May Be

Ending After 2017.

According to Tax Analysts Exclusive: Conversations: Koskinen Looks to Future of Tax Administration, IRS Budget, IRS Commissioner John Koskinen stated on December 12, 2016 that, the Offshore Voluntary Disclosure Program (OVDP) will continue at least through November 2017.

- John Koskinen also stated that One of the reasons people have talked about winding it down is trying to encourage people you've got to get in.

- At some point, it's going to end and then you're going to be stuck with the normal process and you don't want people saying, 'I'll just wait as long as I can.'

- The real incentive, though, is if we find out about you after we know you exist with the banks, then the penalties and the implications go up significantly.

- There are other banks in the world (Hong Kong, Singapore, all of Asia) and other areas (besides Switzerland) in the world than just Europe and people who are maybe hiding money in other places ought to take advantage of that disclosure program, because we're coming.

Like all IRS amnesty programs,

the Offshore Voluntary Disclosure Program (OVDP)

was not meant to be left Open Indefinitely!

____________________

Amnesty Programs and Termination Dates

Additional Reasons Why the OVDP Program

May End After 2017:

- The IRS does not have sustainable staffing on its present and prospective budgets. President Trump recently called for a $239 million cut to the IRS budget in 2018. The proposed spending cut is similar to a reduction proposed in the House last year and represents about 2% of the budget. This alone is not enough but taken in conjunction with recent historical budget cuts and/or lack of increased budgets the IRS staffing has decreased 30% over the last couple of years.

- The average OVDP takes roughly 2 years to complete from submission to receipt of the closing form 906. There are multiple administrative, examination, technicians, and managers involved in this process, especially if there is an opt-out. The amount of time, energy, and resources that the IRS must allocate to this area cannot be sustained. This is akin to the status of normal IRS audit or examination. In that area, the IRS has been very created and resorted to automated matching and computer generated notices as a substitute to the lack of workforce.

- The Foreign Account Tax Compliance Act (FATCA) and Intergovernmental Agreements (IGAs) have produced a treasure trove of information that has been exchanged between foreign countries and the US.

a. Most of the agreements have been in place since 2014 with most information being shared between 2015 and the current year.

b. The IRS could use this information to conduct a match against tax returns and FBARs that have been filed to see which taxpayers may have delinquent (or inaccurate) FBARs and 8938s.

c. They could then use this information to generate computer notices with informational penalties.

- The ICIJ Panama Papers which leaked offshore holdings from 1977 to 2015 and revealed 11.5 million records including the holdings of 140 politicians, 214,088 offshore entities, and 33 persons/companies blacklisted by the US government.

a. This information is public and can be readily used by the IRS as an investigative and matching tool.

b. The offshore entity disclosure is particularly intriguing, since a targeted John Doe Summons, these entities could further produce undetected individuals or companies.

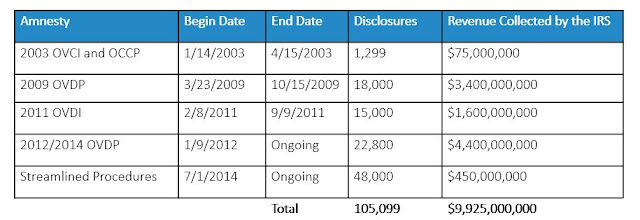

- IRS Data Mining of the > 100,000 disclosures in the previous and current OVDP programs that the IRS can use the information it receives to conduct new audits. The data mining can be used to:

a. Identify taxpayers that have not voluntarily disclosed information.

b. Identify Businesses or entities in tax havens that need further scrutiny via John Does Summons, and/or

c. Identify the paper trail showing the flow of unreported funds from tax haven country to tax haven country.

6. The Internal Revenue Service has stated that the streamlined program was essentially a “Band-Aid” put in place during the implementation of FATCA (Foreign Account Tax Compliance Act). The IRS has also made the following facts known:

a. The IRS can increase the penalty at any time, and under traditional OVDP the penalty has increased steadily, and even more than doubled in six years for certain taxpayers involved with “Bad Banks” aka foreign financial institutions or facilitators.

b. The IRS can eliminate the program at any time and can do so without any warning to taxpayers.

c. If a person is under examination by the IRS (for any reason, even nothing to do with international tax) they are disqualified from submitting to the program.

Before considering Next Steps, Taxpayers should Decide on What to Do Now!

_________________________________________

Taxpayers with Willful Non-Compliance should enter the Offshore Voluntary Disclosure Program As Soon As Possible, since the potential Criminal Exposure is Significant Otherwise.

Taxpayers that are non-willful should currently consider a Streamlined Filing and they should get this process started as early as possible!

For those that receive automated notices with FBAR, 8938, and/or other international informational related penalties, they should also consider their options as there are many successful defenses to the assessment of these penalties (See our blog post US Taxpayers Are Receiving Automated $10,000 Penalty Assessments For Late Filed Form 5471's & 5472's - We Can Help)Whatever your circumstances regarding your unreported offshore income, you should immediately seek a firm that has extensive experience in successfully resolving these types of issues for taxpayers and also has the experience of successfully litigating these types of issues with the IRS.

Do You Still Have Undeclared Income from

Offshore Banks or Financial Advisors?

Want to Know if the OVDP Program is Right for You?

Contact the Tax Lawyers at

Marini& Associates, P.A.

for a FREE Tax Consultation

Toll Free at 888-8TaxAid (888) 882-9243

Sources:

Tax Analysts

The Wolf Group

Golding & Golding

On May 11, 2017 we posted Which of President Trumps Tax Proposals Will Become Law? where we discussed the that the most realistic baseline scenario regarding tax legislation is that

On May 11, 2017 we posted Which of President Trumps Tax Proposals Will Become Law? where we discussed the that the most realistic baseline scenario regarding tax legislation is that