In 2016, there was a clear upward trend in the fight against tax evasion globally. The April 2016 release of the Panama Papers caused an international shake-up that resulted in multiple global tax evasion investigations and regulatory reviews including in the British Virgin Islands, Singapore, Hong Kong, France, Spain, Germany, Australia, Austria, Sweden and the Netherlands.

Governments are also beginning to share information amongst each other about tax evasion activities outside of traditional regulatory platforms. The Joint International Taskforce on Shared Intelligence and Collaboration (JITSIC), met in Paris to conduct the “largest ever simultaneous exchange of tax information and to share results and details on thousands of investigations sparked by the Panama Papers.” The meeting is reported to have resulted in the creation of a “target list” of 100 lawyers, bankers, accountants, and other advisors who enable the use of tax havens.

The JITSIC brings together 37 of the world's national tax administrations that have committed to more effective and efficient ways to deal with tax avoidance. It offers a platform to enable its members to actively collaborate within the legal framework of effective bilateral and multilateral conventions and tax information exchange agreements, sharing their experience, resources and expertise to tackle the issues they face in common.

The JITSIC brings together 37 of the world's national tax administrations that have committed to more effective and efficient ways to deal with tax avoidance. It offers a platform to enable its members to actively collaborate within the legal framework of effective bilateral and multilateral conventions and tax information exchange agreements, sharing their experience, resources and expertise to tackle the issues they face in common.

Individuals and Financial Institutions (FI),

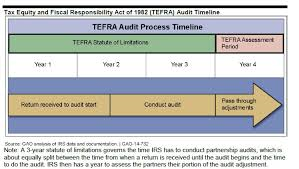

This information is summarized in the following chart.

Higher 50% Penalty.

Read more at: Tax Times blog