The Jarnagin were a married couple. Mr. Jarnagin owns and operates a farm and ranch in British Columbia. He became a Canadian Citizen in 1989 and spent a significant portion of each year in the country. Because of his business there, the Jarnagins maintained bank accounts with the Canadian bank CIBC, which had balances of $4 million on December 31, 2006, $3,500,000 in 2007, and $3,860,000 in 2008. Mr. Jarnagin employed a Canadian accounting firm to handle all his Canadian tax preparation.

Mrs. Jarnagin is a real estate broker and property owner in Oklahoma. She relied heavily on her bookkeeper, Misty Fairchild. Every year, Fairchild would turn over the couple’s financial statements, including the CIBC accounts and their balances to Mrs. Jarnagin’s CPA. During the years that Ms. Fairchild represented the Jarnagins, she went back to school to become an accountant, and eventually a CPA. Mrs. Jarnagin eventually transferred her business to Fairchild and her brother Kyle Zybach, who was also a licensed CPA.

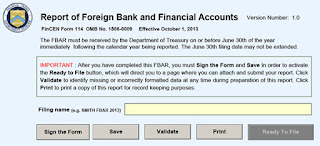

However, neither Zybach nor Fairchild were aware of the Jarnagins’ FBAR reporting requirements, until 2010 when Zybach attended continuing education to maintain his CPA license. Even though the Jarnagin’s financial statements had included the foreign bank account, and their tax returns had disclosed the interest, no FBARs were ever filed. In addition, Schedule B, which asks whether the taxpayer has control over foreign accounts was incorrectly marked “No.”

In 2011, the IRS conducted an audit of the Jarnagins’ 2008 & 2009 tax returns. The audit revealed two wire transfers from the CIBC account. While the tax amounts were confirmed by the audit, the transfers triggered an investigation into the couple’s FBAR violations. Because of the audit, the couple were advised not to participate in a voluntary disclosure program or file the missing FBAR forms. The IRS issued non-willful FBAR penalties against both Mr. & Mrs. Jarnagin for four years totaling $80,000.00.

The non-willful FBAR penalties may not be levied if the taxpayer properly reported the “amount of the transaction or the balance of the account” and had “reasonable cause” for failing to file the FBAR on time.

The Jarnagins argued that they did have reasonable cause: the advice (or lack thereof) of their CPA. This argument is based on three tests described in Neonatology Assocs., P.A. v Commissioner, for reasonable cause:

- The taxpayer hired a competent professional adviser with sufficient expertise to justify reliance

- The taxpayer gave that adviser accurate and complete information, and

- The taxpayer relied in good faith on the adviser’s judgment.

The Jarnagins claim that by providing complete financial statements to their licensed CPAs every year, which included the CIBC account, and relying on those professionals to complete their tax returns, they meet the Neonatology requirements.

The IRS however takes the position that a CPA’s advice isn’t automatically enough to raise a reasonable cause defense. The IRS’s lawyers point to several facts to argue the Jarnagins were willfully negligent in their tax reporting duties:

- Zybach and Fairchild had no experience with foreign accounts

- The Jarnagins didn’t inquire into their CPAs’ experience before hiring them

- The Jarnagins didn’t specifically ask about FBAR reporting requirements or how the international accounts would affect their tax returns

- The Jarnagins did not carefully review the tax returns before signing them.

The IRS argues that other cases provide that a taxpayer is assumed to have read and understood their tax return when they sign it, citing his authority non-FBAR cases, which stand for the proposition that hiring a CPA does not absolve a taxpayer for misstatements or errors in their tax returns.

It remains to be seen if these same arguments hold true for FBAR reporting requirements.Weather the court will distinguish FBAR penalties from the IRS cited case law remains to be seen. If the government wins its claim, it could impose strict liability on taxpayers who don’t even know they have done anything wrong.

Have an FBAR Problem?

Want to Know if the OVDP Program

is Right for You?

Contact the Tax Lawyers at

Marini& Associates, P.A.

for a FREE Tax Consultation

Toll Free at 888-8TaxAid (888) 882-9243

On September 23, 2015, we posted "Some Nonresidents with U.S. Assets Must File Estate Tax Returns" where we discussed that deceased nonresidents who were not American citizens are subject to U.S. estate taxation with respect to their U.S.-situated assets.

On September 23, 2015, we posted "Some Nonresidents with U.S. Assets Must File Estate Tax Returns" where we discussed that deceased nonresidents who were not American citizens are subject to U.S. estate taxation with respect to their U.S.-situated assets.