According to JDSUPRA, The American Bar Association has written to the US Internal Revenue Service, asking it clarify whether assets held as cryptocurrencies such as Bitcoin are subject to the Foreign Bank Account Reports (FBAR) and Form 8938 reporting rules.

“It is unclear whether a taxpayer holding cryptocurrencies on a foreign cryptocurrency exchange (e.g., Xapo.com or Binance.com) or in a wallet maintained by a foreign wallet service provider (e.g., Blockchain.com) is required to report the account(s) on an FBAR as it is unclear whether cryptocurrencies may qualify as a reportable account for FBAR purposes.

There is tension between the Service’s classification of cryptocurrency as “property,” the Securities Exchange Commission’s (“SEC”) classification of cryptocurrency, in certain circumstances, as a “security,” and the Commodity Futures Trading Commission’s (“CFTC”) classification of cryptocurrency as a “commodity.”

- On the one hand, if cryptocurrency is property, then it is arguably not subject to FBAR reporting requirements because it is not, under the current regulatory definitions, a “bank, securities, or other financial account.”

- On the other hand, if cryptocurrency is a “security,” then FBAR reporting requirements may apply under the general rule: “each United States person having a financial interest in, or signature authority over, a bank, securities, or other financial account in a foreign country shall report such relationship to the Commissioner…”

- Moreover, by treating cryptocurrency as “property,” the answer to whether cryptocurrency held in foreign wallets must be reported likely depends on what functions the wallet provider actually provides, which may be difficult for taxpayers to determine in many cases.

- Furthermore, it is unclear how these requirements may apply to taxpayers who hold cryptocurrencies directly on a distributed blockchain.

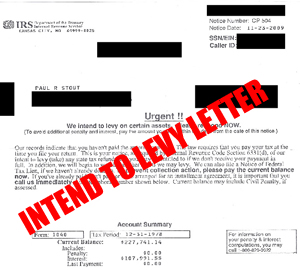

We previously discussed, that an abundance of caution, a taxpayer may want to report their investments in cryptocurrencies on their FBAR and Form the 8938, since Taxpayers who do not properly report the income tax consequences of virtual currency transactions can be audited for those transactions and, when appropriate, can be liable for penalties and interest.

We previously discussed, that an abundance of caution, a taxpayer may want to report their investments in cryptocurrencies on their FBAR and Form the 8938, since Taxpayers who do not properly report the income tax consequences of virtual currency transactions can be audited for those transactions and, when appropriate, can be liable for penalties and interest.

Read more at: Tax Times blog