The Internal Revenue Service in IR-2018-87 reminded U.S. citizens and resident aliens, including those with dual citizenship, to check if they have a U.S. tax liability and a filing requirement. At the same time, the agency advised anyone with a foreign bank or financial account to remember the upcoming deadline that applies to reports for these accounts, often referred to as FBARs.

Here is a rundown of key points to keep in mind:

1. Deadline for Reporting Foreign Accounts

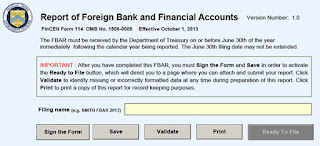

The deadline for filing the annual Report of Foreign Bank and Financial Accounts (FBAR) is the same as for a federal income tax return. This means that the 2017 FBAR, Form 114, must be filed electronically with the Financial Crimes Enforcement Network (FinCEN) by April 17, 2018. FinCEN grants filers missing the April 17 deadline an automatic extension until Oct. 15, 2018, to file the FBAR. Specific extension requests are not required. In the past, the FBAR deadline was June 30 and no extensions were available.

In general, the filing requirement applies to anyone who had an interest in, or signature or other authority, over foreign financial accounts whose aggregate value exceeded $10,000 at any time during 2017. Because of this threshold, the IRS encourages taxpayers with foreign assets, even relatively small ones, to check if this filing requirement applies to them. The form is only available through the BSA E-Filing System website.

2. Reminder: IRS to End Offshore Voluntary Disclosure Program

The Offshore Voluntary Disclosure Program will closeon Sept. 28, 2018. Taxpayers with undisclosed foreign financial assets still have time to use OVDP before the deadline.

The IRS noted it will continue to use tools besides voluntary disclosure to combat offshore tax avoidance, including taxpayer education, whistleblower leads, civil examination and criminal prosecution.

The IRS continues to use streamlined filing compliance procedures that will remain in place and be available to eligible taxpayers. But, as with OVDP, the IRS said it may end the streamlined filing compliance procedures at some point.

3. Most People Abroad Need to File

An income tax filing requirement generally applies even if a taxpayer qualifies for tax benefits, such as the Foreign Earned Income exclusion or the Foreign Tax credit, which substantially reduce or eliminate U.S. tax liability. These tax benefits are only available if an eligible taxpayer files a U.S. income tax return.

A special extended filing and payment deadline applies to U.S. citizens and resident aliens who live and work abroad. For U.S. citizens and resident aliens whose tax home and abode are outside the United States and Puerto Rico, the income tax filing and payment deadline is June 15, 2018. The same applies for those serving in the military outside the U.S. and Puerto Rico.

Interest, currently at the rate of five percent per year, compounded daily, will apply to any payment received after the regular April 17 deadline.

Nonresident aliens who received income from U.S. sources in 2017 also must determine whether they have a U.S. tax obligation. The filing deadline for nonresident aliens is April 17.

4. Special Income Tax Return Reporting for Foreign Accounts and Assets

Federal law requires U.S. citizens and resident aliens to report any worldwide income, including income from foreign trusts and foreign bank and securities accounts. In most cases, affected taxpayers need to complete and attach Schedule B to their tax return. Part III of Schedule B asks about the existence of foreign accounts, such as bank and securities accounts, and usually requires U.S. citizens to report the country in which each account is located.

In addition, certain taxpayers may also have to complete and attach to their return Form 8938, Statement of Foreign Financial Assets. Generally, U.S. citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on this form if the aggregate value of those assets exceeds certain thresholds. See the instructions for this form for details.

5. Specified Domestic Entity Reporting

For tax year 2017, certain domestic corporations, partnerships and trusts that are considered formed for the purpose of holding (directly or indirectly) specified foreign financial assets must file Form 8938 if the total value of those assets exceeds $50,000 on the last day of the tax year or $75,000 at any time during the tax year.

For tax year 2017, certain domestic corporations, partnerships and trusts that are considered formed for the purpose of holding (directly or indirectly) specified foreign financial assets must file Form 8938 if the total value of those assets exceeds $50,000 on the last day of the tax year or $75,000 at any time during the tax year.

For more information on domestic corporations, partnerships and trusts that are specified domestic entities and must file Form 8938, as well as the types of specified foreign financial assets that must be reported, see Do I need to file Form 8938, “Statement of Specified Foreign Financial Assets”?and Form 8938 instructions.

6. Report in U.S. dollars

Any income received or deductible expenses paid in foreign currency must be reported on a U.S. tax return in U.S. dollars. Likewise, any tax payments must be made in U.S. dollars.

Both FinCen Form 114 and IRS Form 8938 require the use of a Dec. 31 exchange rate for all transactions, regardless of the actual exchange rate on the date of the transaction. Generally, the IRS accepts any posted exchange rate that is used consistently. For more information on exchange rates, see

Foreign Currency and Currency Exchange Rates.

7. Expatriate Reporting

Taxpayers who relinquished their U.S. citizenship or ceased to be lawful permanent residents of the United States during 2017 must file a dual-status alien return, attaching Form 8854, Initial and Annual Expatriation Statement. A copy of the Form 8854 must also be filed with Internal Revenue Service, Philadelphia, PA 19255-0049, by the due date of the tax return (including extensions). See the instructions for this form and Notice 2009-85, Guidance for Expatriates Under Section 877A, for further details.

Taxpayers who relinquished their U.S. citizenship or ceased to be lawful permanent residents of the United States during 2017 must file a dual-status alien return, attaching Form 8854, Initial and Annual Expatriation Statement. A copy of the Form 8854 must also be filed with Internal Revenue Service, Philadelphia, PA 19255-0049, by the due date of the tax return (including extensions). See the instructions for this form and Notice 2009-85, Guidance for Expatriates Under Section 877A, for further details.

Need Tax Help?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact US at

or Toll Free at 888-8TaxAid (888 882-9243).