The number of tax returns examined by the IRS drops every year, to the point where the agency now audits just 0.5 percent of all returns, but that still amounts to over a million adversely affected taxpayers.

In order to determine how to respond to an IRS Tax Audit, it is helpful to understand how tax returns are selected for examination. The IRS selects returns for examinations in several ways, some based upon objective criteria coded into a carefully protected computer program and others based upon old fashioned investigation work.

Selection for an IRS Audit does not always suggest there’s a problem. The IRS uses several different methods:

- Random Selection and Computer Screening? Sometimes returns are selected based solely on a statistical formula. The IRS compares your tax return against “norms” for similar returns. The IRS develop these “norms” from audits of a statistically valid random sample of returns, as part of the National Research Program the IRS conducts. The IRS uses this program to update return selection information.

Many returns are selected through the use of a computer program called the Discriminant Function System (DIF). This program scores each return that is filed for potential error based upon past IRS audit experience. The returns receiving high scores are made available for examination. IRM 4.1.3.2 (10-24-06). The DIF formulas are listed in the Law Enforcement Manual, which is not publicly available.

- The Discriminate Function (DIF) score is the product of a mathematical formula for identifying and selecting returns for examination.

- The program scores tax returns using a formula based on historic information obtained from specific examination programs. A high DIF score indicates a high potential for adjustment.

- The Service periodically conducts compliance studies to update and reformulate its basis for audit selection formulas.

- Different types of taxpayers and returns are subject to different DIF formulas. While the specifics of the program are not public, certain items appear to cause a return to be selected for examination, such as:

i. Participation in a Tax Shelter,

ii. A large Charitable Contributions,

iii. A Home Office Deductions

iv. A Large Travel & Entertainment Expense (e.g. Sky Box. etc.) or

v. A Large Automobile Expense.

Returns selected under the DIF program are then manually screened, so that attachments to the return and other data that a computer cannot detect can be properly considered.

Other returns are selected at random under current national or regional studies, such as the National Research Program (NRP), the successor to the Taxpayer Compliance Measurement Program (TCMP). The results of these examinations are used to measure and evaluate taxpayer compliance and to revise the DIF program. NRP and TCMP audits.

Alternatively, the IRS may receive information from other federal agencies. (See IRM 4.6.2 (8-1-02)) and they may also receive information through federal-state programs (See IRM 4.1.4.2.4 (10-24-06)).

- Related examinations – The IRS may select your returns when they involve issues or transactions with other taxpayers, such as Business Partners or Investors, whose returns were selected for audit. This is affectionately referred to as an “Audit by Infection.”

- Review After Selection by IRS - After selection, an experienced auditor reviews the return. They may accept it; or if the auditor notes something questionable, they will identify the items noted and forward the return for assignment to an examining group.

a. Filing an amended return does not affect the selection process of the original return. However, amended returns also go through a screening process and the amended return may itself be selected for audit.

b. A refund is not necessarily a trigger for an audit, but it could trigger an examination.

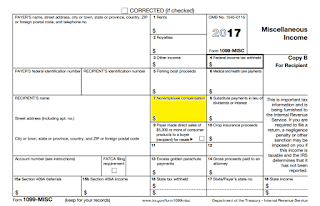

4. Information Provided by 3rd Parties – The Service also relies on information provided by third parties, such as banks, brokers and employers. Much of this information is required to be reported by payers of certain types of income on Forms W-2 or 1099. Unreported income is perhaps the easiest-to-avoid red flag and, by the same token, the easiest to overlook. Any institution that distributes an individual’s income will report it to the IRS, and the more income sources you have, the greater the difficulty in keeping track. Old brokerage accounts are commonly overlooked, as are Form 1099s and distributions from a college savings account to pay tuition.

The IRS will typically receive a copy of all the tax forms that you do, including distributed income. The IRS will match the reported items to a person’s return. If they see something missing, they will automatically conduct at least a letter audit.

5. Referrals by IRS Agents - Referrals may also be made by other examining agents. For example, the return of a party related to another taxpayer being audited, such as the partners of a partnership being audited may also be selected for audit. The Service also may investigate tips regarding potential noncompliance, and select those returns for audit as a result.

6. Other IRS Audit Triggers - Examinations may also be triggered a variety of other ways, such as, by mathematical errors or missing information. Also, a claim for refund can potentially trigger an examination.

a. Foreign Accounts

The Foreign Account Tax Compliance Act has strict reporting requirements for foreign

bank accounts. The law requires overseas banks to identify American asset holders

and provide information to the IRS.

Individuals must report foreign assets worth at least $50,000 on Form 8938.

It used to be you didn’t have to report it; you just had to check a box that you had one.

Now you have to not only check the box, you have to identify the institution and the

highest dollar amount the account was at the previous year.

The regulations demand openness, which in turn increases the likelihood of an audit.

That’s because of a perception that taxpayers with foreign accounts are trying to hide

income offshore.

Compliance with the law increases the likelihood of an audit, and noncompliance can

result in stiff penalties and significant legal liabilities.

b. Overstated Business Expenses

The IRS will give a close look to excessive business tax deductions.

The agency uses occupational codes to measure typical amounts of travel by profession,

and a tax return showing 20% or more above the norm might get looked at.

Also, take-home vehicles are you consider strictly business, so a specific employer

purpose for allowing the employeetaking the vehicle home should be documented.

Generally speaking, the IRS can be strict about mixing business and personal expenses.

Meals and entertainment can be allowable, but exceeding the occupational norm by a

great amount invites an audit. Meals and entertainment oftentimes can be a blurred line, so

be sure to document what is and isn't a personal expense.

c. Earning More than $200,000

Last year the IRS audited about 1% of those earning less than $200,000, and almost 4% of

those earning more, according IRS data. Raise the threshold to $1 million and the

percentage of audited tax returns increases to 12.5%.

The same patterns exist when it comes to business tax returns: 1% of corporations with

less than $10 million in assets, compared with 17.6% above that threshold.

Higher incomes are likely to result in more complex tax returns that are more likely to

contain audit triggers. More importantly, the IRS wants to maximize return on investment,

something the agency gets better at every year:

The IRS has broad authority to examine tax returns. An understanding of the rights and responsibilities of both taxpayers and the examining agent can help reduce the scope of a tax audit or examination and can lead to a more favorable disposition.

Have a Tax Problem?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact US at

or Toll Free at 888-8TaxAid (888 882-9243).

The number of tax returns examined by the IRS drops every year, to the point where the agency now audits just 0.5 percent of all returns, but that still amounts to over a million adversely affected taxpayers.

The number of tax returns examined by the IRS drops every year, to the point where the agency now audits just 0.5 percent of all returns, but that still amounts to over a million adversely affected taxpayers.