IRS has issued proposed regs that describe and clarify the requirements that must be met by a taxpayer in order to defer the recognition of gains by investing in a qualified opportunity fund (QOF) under Code Sec. 1400Z-2, as added by the Tax Cuts and Jobs Act (TCJA, P.L. 115-97; 12/22/2017).

The proposed regs provide rules allowing a corporation or partnership to self-certify as a QOF and provide initial proposed rules on some of the requirements that must be met by a corporation or partnership in order to qualify as a QOF.

Taxpayer may rely on these regs as indicated in the regs. (Preamble to Prop Reg REG-115420-18, Proposed Reg § 1.1400Z-2(a)-1, Proposed Reg § 1.1400Z-2(c)-1, Proposed Reg § 1.1400Z-2(d)-1, Proposed Reg § 1.1400Z-2(e)-1; IR 2018-206, 10/19/2018)

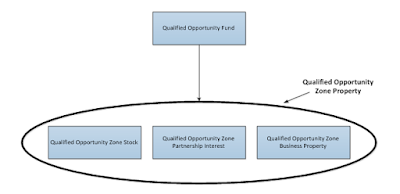

The basic concepts of the QOF provisions can be summarized as follows:

Step 1: A QO Fund is formed and certified by the Department of Treasury.

Step 2: An investor with a recently realized CG elects to invest this gain into the QO Fund, taking stock or a partnership interest in return. By so doing, the investor gets to defer including the CG in income.

Step 3: The QO Fund uses the investment to acquire “qualified opportunity zone property.” This investment represents the QO Fund’s interest in the underlying business in the low-income community.

Step 4: The investor holds the interest for as long as he desires or for some period of time as may be stipulated in the investment agreement with the QO Fund.

Step 5: If the investor sells or exchanges his QO Fund interest before Dec. 31, 2026, he will recognize the deferred CG. If the holding period is at least 5 years, the investor gets a basis allocation that will offset some of his CG (there is more basis allocation if the holding period is at least 7 years).

Step 6. In any event, the investor’s CG deferral period ends on Dec. 31, 2026, and so if the investment is still outstanding, the deferred CG must be recognized then. The holding periods noted in Step 5 are taken into account at this point.

Step 7: If the investor holds his interest in the QO Fund for at least 10 years, he is entitled to a major fair market value (“FMV”) basis step-up so that any appreciation in the value of his interest can be excluded from income.

The QO Zone provisions give incentive to potential investors in QO Funds by allowing for:

(a) temporary deferral of CG recognition,

(b) a possible step-up in the basis of their investment, and

(c) possible permanent exclusion of CG from the growth of the QO Fund investment if the holding period is at least 10 years.

Need Help Forming A

Qualified Opportunity Fund (QOF)?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact us at:

or Toll Free at 888-8TaxAid (888 882-9243).