The deadline for filing federal income tax returns is fast approaching and nationwide tax season is in full force.

During this hectic time of year, the Department of Justice’s Tax Division takes a moment to remind the public that year round, tax enforcement efforts are continually underway across the country. The Tax Division in collaboration with U.S. Attorney’s Offices and the Internal Revenue Service (IRS) investigates and prosecutes individuals and corporations across a wide spectrum of occupation and industry.

“Filing a tax return and paying taxes are serious acts and willfully filing false and fraudulent tax returns and deliberately evading paying taxes are criminal acts,” said Principal Deputy Assistant Attorney General Richard E. Zuckerman of the Justice Department’s Tax Division.

Throughout the past year, federal prosecution of tax crime has included a range of income levels, professionals, small business owners and wage earners and encompassed a broad spectrum of tax crimes from offshore fraudulent tax activity to employment tax fraud to identity theft. Tax enforcement efforts are ongoing. The Tax Division and its partners remain vigilant in the fight against tax crime.

Recent Tax Prosecutions of Individuals

- In April 2019, a Houston, Texas, man was sentenced to 360 months in prison for multiple conspiracy and tax crimes, including corporate tax evasion. The defendant engaged in the fraudulent sale of second-hand prescription drugs and tax crimes. The court imposed a criminal forfeiture money judgment of $20,326,464.17 and ordered $716,986 in restitution to the IRS.

- In April 2019, a District of Columbia woman was sentenced to 54 months in prison for conspiring to defraud the United States and commit theft of public money and aggravated identity theft. She engaged in a fraudulent tax refund scheme and was ordered to pay $1,806,876.66 in restitution to the IRS.

- In March 2019, a Salinas, California, woman was sentenced to 60 months in prison for conspiring to file false income tax returns and bank fraud. She was ordered to pay $1,641,610 in restitution to the IRS.

- In January 2019, a Union, South Carolina, mechanic was sentenced to 36 months in prison for wire fraud and filing a false income tax return. After creating a false invoice scheme, he embezzled money from his employer and failed to report the income on his tax returns. He was ordered to pay $1,941,377.32 in restitution.

- In November 2018, a Farmington, Michigan, trucking business owner was sentenced to 33 months in prison for wire fraud and willfully failing to file a tax return. The court ordered restitution of $2,919,265 to a third party victim and $142,069 to the IRS.

- In October 2018, a former IRS-Criminal Investigation special agent was sentenced to 51 months in prison for filing false tax returns, obstruction of justice, and stealing government money. A federal jury in the Eastern District of California convicted the defendant, who was also a CPA.

Recent Employment Tax Prosecutions

- In March 2019, a Raleigh, North Carolina, mental health executive was sentenced to 30 months in prison for failing to report and pay almost $1.7 million in employment taxes to the IRS.

- In November 2018, a Collinsville, Virginia, pharmacist was sentenced to 41 months in prison for failing to pay over more than $5 million in employment taxes to the IRS. The defendant spent the money owed to the United States on a Jeep Grand Cherokee, a jet ski, stock market investments and real property.

- In June 2018, a former Virginia Software Company CEO was sentenced to 21 months in prison for conspiring to defraud the government of more than $1.8 million in payroll taxes. Along with his co-conspirator, he also failed to remit the full amount of employee retirement contributions to the company’s retirement plan.

Recent Prosecutions Involving Offshore Banking

- In March 2019, one of the largest Israeli banks, Mizrahi-Tefahot Bank Ltd., and two of its subsidiaries, United Mizrahi Bank (Switzerland) Ltd. and Mizrahi Tefahot Trust Company Ltd., entered a deferred prosecution agreement (DPA) with the Department of Justice. Mizrahi-Tefahot Bank Ltd. paid $195 million to the United States as a direct result of its role in defrauding the United States, specifically the IRS, by conspiring with U.S. taxpayer-customers and enabling U.S. taxpayers to hide income and assets from the IRS.

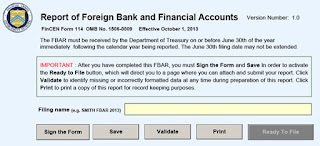

- In October 2018, a Scottsdale, Arizona man, who managed a resort with family members in Pagosa Springs, Colorado, was sentenced to 18 months in prison for filing a false tax return underreporting his income and omitting $9.7 million in investment income from two offshore bank accounts in Liechtenstein.

Read more at: Tax Times blog