Spending more that 3 months a year in the U.S. may trigger taxable residency without realizing it, bringing with it the additional responsibility of financial reporting obligations and potentially creating tax liability for any affiliated offshore companies.

You will be considered a United States resident for tax purposes if you meet the substantial presence test for the calendar year. To meet this test, you must be physically present in the United States (U.S.) on at least:

- 31 days during the current year, and

- 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

- All the days you were present in the current year, and

- 1/3 of the days you were present in the first year before the current year, and

- 1/6 of the days you were present in the second year before the current year.

People who unknowingly pass this threshold may be insulated from U.S. income taxes, where there country of residence as an income tax treaty with the U.S., but they’re still considered U.S. residents for other purposes like information reporting.

As explained in IRS Publication 519 (U.S. Tax Guide for Aliens): Effect of Tax Treaties… If you are a dual-resident taxpayer, you can still claim the benefits under an income tax treaty. A dual-resident taxpayer is one who is a resident of both the United States and another country under each country’s tax laws. The income tax treaty between the two countries must contain a provision that provides for resolution of conflicting claims of residence (tie-breaker rule). If you are treated as a resident of a foreign country under a tax treaty, you are treated as a nonresident alien in figuring your U.S. income tax. For purposes other than figuring your tax, you will be treated as a U.S. resident...

As explained in IRS Publication 519 (U.S. Tax Guide for Aliens): Effect of Tax Treaties… If you are a dual-resident taxpayer, you can still claim the benefits under an income tax treaty. A dual-resident taxpayer is one who is a resident of both the United States and another country under each country’s tax laws. The income tax treaty between the two countries must contain a provision that provides for resolution of conflicting claims of residence (tie-breaker rule). If you are treated as a resident of a foreign country under a tax treaty, you are treated as a nonresident alien in figuring your U.S. income tax. For purposes other than figuring your tax, you will be treated as a U.S. resident...

Where a foreign resident is able claim Treaty Tiebreaker provision, they may still need to file:

- Form 114 - Report of Foreign Bank and Financial Accounts (FBAR),

- Form 5471- Information Return of U.S. Persons With Respect to Certain Foreign Corporations

- Form 8938 - Statement of Specified Foreign Financial Assets (where treaty tiebreaker claim is not made on timely file return). and

- Forms 3520 or 3520-A - Annual Reports Regarding Foreign Trust.

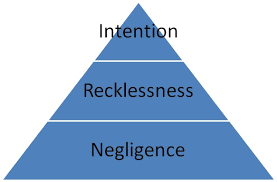

The penalty for failing to file any of the above mentioned forms is:

- Form 114 is $10,000 where the IRS believes that the taxpayer didn't intentionally fail to file the FBAR. However, where the IRS believes the omission was willful then the penalty for failing to file Form 114 is the greater of $100,000 or 50% of the balance in the foreign account.

- For Form 5417 & 8938 the IRS may assert a $10,000 penalty for each failure for each applicable annual accounting period, plus an additional $10,000 for each month the failure continues, beginning 90 days after the taxpayer is notified of the delinquency, up to a maximum of $60,000.

- Form 3520: Greater of $10,000 or the following (as applicable):

- 35% of the gross value of any property transferred to a foreign trust for failure by a U.S. transferor to report the creation of or transfer to a foreign trust.

- 35% of the gross value of the distributions received from a foreign trust for failure by a U.S. person to report receipt of the distribution.

- 5% of the gross value of the portion of the foreign trust's assets treated as owned by a U.S. person under the grantor trust rules (Sec. 671 through 679) for failure by the U.S. person to report the U.S. owner information.

- Form 3520-A: Greater of $10,000 or the 5% penalty (discussed above).

This is just one more reason that NRA's should consult with an experienced attorney before coming to the US for any long period of time and certainly for pre-immigration planning!

Read more at: Tax Times blog