According to Law360, in Daphne Jeanette Rost, executor of the Estate of John H. Rebold, v. U.S., case number 1:19-cv-00607, in the U.S. District Court for the Western District of Texas the court held that an estate will not recover almost $600,000 in penalties and interest it had paid for failing to report foreign financial accounts after a federal court determined there was no dispute that it had established an entity qualifying as a foreign trust.

John H. Rebold's estate set up a foundation that clearly was a trust because it did not conduct business and existed for beneficiaries that did not control it, the court ruled in a decision released Monday. The estate offered no facts to rebut the government's argument that it was not a domestic entity, the court added, dismissing the case.

Rebold traveled to Switzerland in 2005 to establish the foundation, which was formed under Liechtenstein law as an entity known as a Stiftung. He deposited $2 million in 2005 and $1 million in 2007. Rebold failed to report the creation, the transfers or his ownership on his 2005-2007 tax returns.

The Internal Revenue Service deemed the entity a foreign trust and assessed interest and penalties of $596,830 against Rebold. He paid and filed a refund suit before dying. Both the estate and the government filed for summary judgment.

The core of the dispute is whether the foundation qualifies as a foreign trust for tax purposes, the court said. Treasury Regulations Sections 301.7701–1 and 301.7701–4(a) state that an entity is a trust if it preserves property for beneficiaries who do not participate in these duties and are not associates in a business.

The foundation meets these criteria, the court said. Its formation documents state its purpose is defraying the costs of Rebold's family. The documents also specifically state the foundation does not conduct business, the court said.

The next question is whether the foundation is a foreign trust, the court said. Federal law defines a foreign trust as any trust that is not domestic, it said. A domestic trust, it said, must meet two tests: It is administered by a U.S. court and controlled by a person in the U.S. The estate failed to present any evidence on these questions, so the court awarded summary judgment for the government.

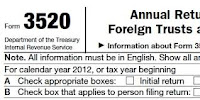

Received a CP15 Notice and 25% Penalty

For Late Filing Form 3520A?

Or

Received a CP15 Notice and $10,000 Penalty

For Failure To File 3520?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax HELP Contact us at:

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog