According to the DoJ, the founder of a Russian bank pleaded guilty on October 1, 2021 to filing a materially false tax return.

“In 2013, when the value of Oleg Tinkov’s investment in his bank’s stock rose to over a billion dollars, Tinkov quickly renounced his U.S. citizenship and then lied to the IRS in a ploy to evade ‘exit taxes’ he knew were due,” said Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division.

“Oleg Tinkov brazenly violated United States tax law,” said Acting U.S. Attorney Stephanie M. Hinds for the Northern District of California. “No one who enjoys the immense benefits of United States citizenship, as Tinkov did, may avoid the corresponding obligation to support the country he chose. Tax evaders should take notice of the long reach of U.S. law enforcement.”

“Tinkov renounced his U.S. Citizenship shortly after receiving millions of dollars,” said Acting Special Agent in Charge Darrell J. Waldon of the IRS-CI Washington D.C. Field Office. “Despite his knowledge of U.S. tax reporting requirements, he substantially understated his wealth on filings with the IRS.

According to the plea agreement, Oleg Tinkov, also known as Oleg Tinkoff, was born in Russia and became a naturalized United States citizen in 1996. From that time through 2013, he filed U.S. tax returns. In late 2005 or 2006, Tinkov founded Tinkoff Credit Services (TCS), a Russia-based branchless bank that provides its customers with online financial and banking services. Through a foreign entity, Tinkov indirectly held the majority of TCS shares.

In October 2013, TCS held an initial public offering (IPO) on the London Stock Exchange and became a multi-billion dollar, publicly traded company. As part of going public, Tinkov sold a small portion of his majority shareholder stake for more than $192 million, and his assets following the IPO had a fair market value of more than $1.1 billion. Three days after the successful IPO, Tinkov went to the U.S. Embassy in Moscow, Russia, to relinquish his U.S. citizenship.

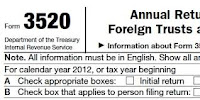

As part of his expatriation, Tinkov was required to file a U.S. Initial and Annual Expatriation Statement. This form requires expatriates with a net worth of $2 million or more to report the constructive sale of their assets worldwide to the IRS as if those assets were sold on the day before expatriation. The taxpayer is then required to report and pay tax on the gain from any such constructive sale.

Tinkov was told of his filing and tax obligations by both the U.S. Embassy in Moscow and his U.S.-based accountant. When asked by his accountant if his net worth was more than $2 million for purposes of filling out the expatriation form, Tinkov lied and told him he did not have assets above $2 million. When his accountant later inquired whether his net worth was under $2 million, rather than answer the question, Tinkov filled out the expatriation form himself falsely, reporting that his net worth was only $300,000. On Feb. 26, 2014, Tinkov filed a false 2013 individual tax return that falsely reported his income as only $205,317. In addition, Tinkov did not report any of the gain from the constructive sale of his property worth more than $1.1 billion, nor did he pay the applicable taxes as required by law. In total, Tinkov caused a tax loss of $248,525,339.

Tinkov was arrested on Feb. 26, 2020, in London, United Kingdom (UK), on these charge. Since that time, he has been contesting extradition on medical grounds. Tinkov has provided to the government and a court in the UK expert medical reports supporting his claim that he is undergoing a UK-based intensive treatment plan for acute myeloid leukemia and graft versus host disease, which has rendered him immunocompromised and unable to safely travel. As part of the plea, Tinkov has agreed to make the expert reports available to the court.

Tinkov’s sentencing hearing is scheduled for Oct. 29 before U.S. District Judge Jon S. Tigar. Under the terms of the plea agreement, Tinkov agrees to pay no less than $506,828,377, which includes the 2013 taxes, the civil fraud penalty, and statutory interest on that tax, totaling $448,957,108 as well as tax liabilities for other years that Tinkov acknowledged he owes.

Per the terms of the plea agreement, the parties have agreed to recommend a custodial sentence of time served, followed by one year of supervised release, and an additional fine of $250,000. This recommendation binds the court once it accepts the plea agreement.

Read more at: Tax Times blog