On June 19, 2019 we posted Negligent FBAR Penalty NOT Limited to $10K Per Year, where we discussed that the federal district court of California, upheld the IRS’ imposition of separate non-willful penalties against 13 foreign accounts disclosed on a single late FBAR return. In United States vs. Jane Boyd, the taxpayer had a financial interest in and/or otherwise controlled 14 financial accounts in the United Kingdom with balances collectively exceeding $10,000. The IRS assessed 13 separate FBAR penalties against Boyd, treating each reported account as a separate non-willful violation. One account was not penalized based on IRS mitigation rules and the District Court agreed with the IRS assessment.

The Court of Appeals for the Ninth Circuit, reversed the district court decision and has held that the $10,000 non-willful FBAR penalty (for failure to file the FBAR) applies per FBAR form, not per the number of financial accounts (e.g., bank accounts) required to be reported on the form. This ruling aligns with all district court rulings concerning this issue.

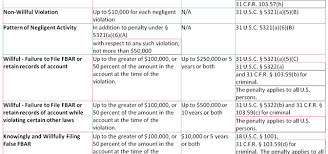

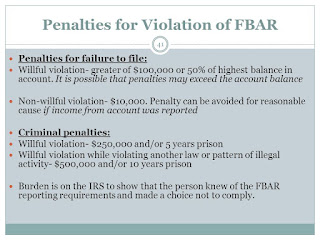

The penalty for violating the FBAR requirement is set forth in 31 USC § 5321(a)(5). The amount of the penalty depends on whether the violation was non-willful or willful.

The maximum penalty amount for a non-willful violation of the FBAR requirements is $10,000 (adjusted for inflation for violations after 2015). (31 USC § 5321(a)(5)(B)(i))

Since one FBAR can contain reports on multiple financial accounts, each containing more than $10,000, it is unclear if the $10,000 non-willful penalty under 31 USC § 5321(a)(5)(B)(i) applies per account or only per the one form that should have been filed.

The district court hearing the Boyd case had held that the penalty for a non-willful FBAR violation relates to each account required to be shown on the FBAR. Thus, IRS could impose the statutory maximum penalty of $10,000 for each of the taxpayer's thirteen accounts that should have been reported on one FBAR. (US v. Boyd, (DC CA) 123 AFTR 2d 2019-1651)

But subsequent to the district court's decision in Boyd, three other district courts came to the opposite conclusion. They found that the $10,000 non-willful penalty applies only to the FBAR form itself, not the number of accounts required to be shown on the FBAR. (US v. Bittner (DC TX) 126 AFTR 2d ¶2020-5011, US v. Kaufman, (DC CT) 127 AFTR 2d ¶2021-342, and US v. Giraldi, (DC NJ) 127 AFTR 2d ¶2021-510)

Ms. Boyd had a financial interest in multiple financial accounts in the United Kingdom during 2010. She was required to report these accounts on a timely-filed FBAR, but she did not.

The IRS found that that she had committed 13 non-willful violations of the FBAR reporting requirements, i.e., one for each account she failed to report. And the IRS assessed a penalty totaling more than $10,000, for the 13 violations.

The Court of Appeals for the Ninth Circuit, in reasoning that was similar to the reasoning in Bittner, Kaufman, and Giraldi, reversed the district court and found that the FBAR non-willful penalty applies per form, not per account. Therefore "the maximum penalty for such a violation shall not exceed $10,000."

Read more at: Tax Times blog