The IRS has highlighted two options that enable taxpayers to interact with the agency electronically: using electronic or digital signatures on certain paper-filed forms and emailing documents to resolve examination and collection activities. The IRS says these expanded digital options enhance the taxpayer experience and build on the earlier addition of virtual services and online tools such as electronic signatures for third party authorizations and an online account for tax professionals.

In March 2020, the IRS issued guidance to its employees allowing electronic or digital signatures on certain forms that normally required a handwritten or "wet" signature. A complete list of the forms can be found in a fact sheet. Currently, this flexibility is authorized through October 31, 2023, and the IRS is working to extend them based on taxpayer interest, according to the agency.

The IRS also accepts images of signatures and digital signatures on these documents related to compliance interactions:

-

Extensions of statute of limitations on assessment or collection

-

Waivers of statutory notices of deficiency and consents to assessment

-

Agreements to specific tax matters or tax liabilities (closing agreements)

-

Any other statement or form traditionally collected by IRS personnel outside standard filing procedures.

This email option is available only for those working with an IRS enforcement employee to resolve an examination or collection activity, and the choice to transmit documents electronically is solely up to each individual.

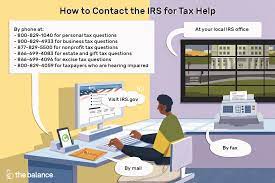

All existing and previously allowable means of receiving and transmitting information, such as eFax, established secured messaging systems, or postal mail remain available to anyone who chooses that option.

Have an IRS Tax Problem?

Contact the Tax Lawyers at

Marini & Associates, P.A.

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog