Under the broker information reporting rules, brokers must report transactions in securities to both the IRS and the investor. These transactions must be reported on Form 1099-B. Legislation enacted in 2021 extends these broker information reporting rules to cryptocurrency exchanges, custodians, or platforms (e.g., Coinbase, Gemini, or Binance), and to digital assets such as cryptocurrency (e.g., Bitcoin, Ether, or Dogecoin).

In addition to extending the above information reporting requirement to cryptocurrency, the legislation also extends existing cash reporting rules (for cash payments of $10,000 or more) to cryptocurrency, so that businesses that accept payments of $10,000 or more in cryptocurrency will have to report that to the IRS (on IRS Form 8300).

The new reporting rules apply to transactions that take place in 2023 and later years.

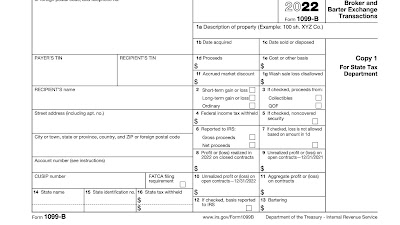

Existing broker reporting rules. Under current rules, if you have a stock brokerage account, then whenever you sell stock or other securities, you receive a Form 1099-B at the end of the year. On that form, your broker reports details of transactions, such as sale proceeds, relevant dates, your tax basis for the sale, and the character of gains or losses.

Furthermore, under the "broker-to-broker" reporting rules, if securities are transferred from one broker to another broker, then the old broker must furnish a statement with relevant information, such as tax basis, to the new broker.

New reporting for digital assets (most cryptocurrencies, and potentially some non-fungible tokens (NFTs)). The 2021 legislation expanded the definition of "brokers" who must furnish Forms 1099-B to include businesses that are responsible for regularly providing any service accomplishing transfers of digital assets on behalf of another person (for example, cryptocurrency exchanges). Thus, any platform on which you can buy and sell cryptocurrency will have to report digital asset transactions to the IRS and to you at the end of each year.

The cryptocurrency exchanges/platforms will have to gather information from customers, so that they can properly issue Forms 1099-B at the end of each tax year. Specifically, cryptocurrency exchanges will have to get the customer's name, address, and phone number, the gross proceeds from the sale of digital assets, and capital gains or losses and whether these were short-term (held for one year or less) or long-term (held for more than one year).

Note that it's not yet known whether exchanges/platforms will have to file Form 1099-B itself (modified to include digital assets) or some other, new IRS form.

Digital assets defined. For these reporting requirements, a "digital asset" is any digital representation of value recorded on a cryptographically secured distributed ledger or any similar technology. The IRS is allowed to modify this definition.

As it stands, the definition will capture most cryptocurrencies, and could potentially include some non-fungible tokens (NFTs) that are using blockchain technology for one-of-a-kind assets like digital artwork.

Cash transaction reporting on Form 8300 will apply to cryptocurrency. Under a set of rules separate from the broker reporting rules, when a business receives $10,000 or more in cash in a transaction, that business must report the transaction, including the identity of the person from whom the cash was received, to the IRS on Form 8300. For this cash reporting requirement, businesses will have to treat digital assets like cash.

IRS's Form 8300 requires the reporting of the identifying information of the individual from whom the cash was received-including address, occupation, and taxpayer identification number-as well as other information. The current-law rules that apply to cash usually apply to in-person payments in actual cash. It may be difficult for businesses seeking to comply with the post-2022 reporting rules for more than $10,000 in cryptocurrency to collect the information that must be reported on Form 8300.

What you should know. If you use a cryptocurrency exchange or platform, and it has not already collected a Form W-9 from you (seeking your taxpayer identification number), expect it to do so.

Cryptocurrency exchanges and platforms, in addition to collecting information from their customers, will need to begin tracking the holding period and the buy and sell prices of the digital assets in customers's accounts.

Be aware that the transactions subject to the new reporting rules will include not only the selling of cryptocurrencies for fiat currencies (government-issued currency such as the U.S. dollar), but also exchanges of cryptocurrencies for other cryptocurrencies.

Finally, it's good to keep in mind that the cryptocurrency exchanges or platforms will probably not have all the information they need to meet their reporting requirements under the new rules. This may make the first year of reporting for digital assets challenging for investors, as well as exchanges and platforms.

Sources:

Read more at: Tax Times blog