According to Law360, big news came out of the U.S. Court of Appeals for the Eleventh Circuit at the end of 2021, involving a closely watched conservation easement case.

In Hewitt v. Commissioner of Internal Revenue, the Eleventh Circuit overturned the U.S. Tax Court when it held that a provision in the conservation easement regulations, promulgated in the 1980s, is procedurally flawed under the Administrative Procedure Act.

This case should be of interest to those following the developing body of cases involving the application of the APA's rules to U.S. Department of the Treasury and Internal Revenue Service determinations.

Also the holding of this case has important implications for the dozens, if not hundreds of taxpayers that have had conservation easement deductions challenged based on these regulations.

The Treasury regulations at issue in Hewitt are the so-called proceeds regulations codified at Treasury Regulation Section 1.170A-14(g)(6)(ii), which provides guidance on how to allocate condemnation sale proceeds between the donor and the donee in the rare event of an extinguishment of a conservation easement.

These regulations are intended to ensure that a donation complies with the protected-in-perpetuity requirement under Internal Revenue Code Section 170(h)(5). The proceeds regulations require a proportional allocation of proceeds between the donor and the donee according to a specific formula.

The donee must receive a share of the sale proceeds that is "at least equal to the proportionate value that the perpetual conservation restriction at the time of the gift, bears to the value of the property as a whole at that time."

Taxpayers can deviate from that formula only where "state law provides that the donor is entitled to the full proceeds from the conversion without regard to the terms of the prior perpetual conservation restriction."

Under the easement at issue in Hewitt, in the unlikely event that the easement was extinguished, the share of the sales proceeds payable to the donee would generally be determined under the regulations' prescribed proportionate value formula.

But the easement also provided that the donee's share would be reduced by any appreciation attributable to post-donation improvements to the property.

Based on this improvements provision, the IRS denied the taxpayers' entire charitable contribution deduction, arguing that the easement improperly reduced the donee's share of extinguishment proceeds in violation of the proceeds regulations.

In the Tax Court, the taxpayers argued that the IRS misinterpreted the proceeds regulations and that, in any event, the proceeds regulations were procedurally and substantively invalid. The Tax Court rejected both of those arguments and sustained the IRS' determination.

Therefore, the court held that the commissioner's interpretation of the regulations to disallow the subtraction of improvements "was arbitrary and capricious and therefore invalid under the APA's procedural requirements," and reversed the Tax Court, ruling in favor of the taxpayers.

For other taxpayers in the Eleventh Circuit that have only the improvements provision issue and no other identified problems with their easement deeds, this case should be considered a big win and should result in the allowance of the claimed conservation easement deductions — subject, of course, to any valuation-based challenges. But for other taxpayers, the scope of this decision is arguably less clear.

We may get more clarity on the scope of Hewitt when the Sixth Circuit issues its decision in Oakbrook. The decision is expected imminently, oral argument was held a few weeks prior to the Hewitt argument.

The Oakbrook facts overlap significantly with those in Hewitt, it has both the improvement provision issue and a similar APA challenge to the regulations.

In addition, the Oakbrook easement has a second problem under the proceeds regulations, because it provides that the donee is entitled to a fixed value determined at the time of the donation, rather than a proportionate value determined at the time of the sale.

Thus, it is possible that the Sixth Circuit will sidestep the issues in Hewitt involving the validity of the regulations entirely, by deciding that the proportionate value problem violates the statute, rather than the regulations.

Alternatively, the court could review the validity of the proceeds regulations as applied to the proportionate value issue, without addressing the improvement provision.

Finally, and most interestingly, it is possible that the Oakbrook court will address the very same issues that were addressed in Hewitt and either agree with Hewitt or set up a split in the circuits regarding the APA challenge to the regulations.

Taking a step back from its implications on conservation easement cases, Hewitt represents one of the few successful challenges to a Treasury regulation on procedural grounds.

The Treasury and IRS were long considered immune from the APA's requirements, but the trend has shifted in recent years. We expect that this trend could continue, and we may continue to see more challenges to Treasury and IRS agency determinations in appropriate cases.

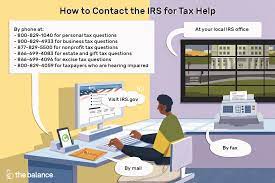

Have an IRS Tax Problem?

Contact the Tax Lawyers at

Marini & Associates, P.A.

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog