According to Law360, a California woman the government is suing in federal court for nearly $120 million in penalties over alleged violations of foreign bank account reporting rules is not complying with IRS summonses, the U.S. said on March 16, 2022.Barry without The case is U.S. v. Francis Burga et al., case number 5:18-cv-01633, in the U.S. District Court for the Northern District of California, San Jose Division.

Francis Burga has produced documents sought by the Internal Revenue Service, according to a status report filed by the U.S., but hasn't indicated when additional documents she requested from another individual will arrive. The government has said that it can't determine whether she has complied with the summonses, which are being enforced by a court order, until it can review all the material they are expected to yield.

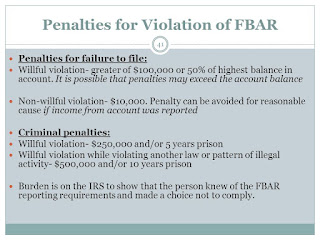

Efforts to enforce the summonses are unfolding parallel to a separate case centered on claims that Burga and her late husband willfully failed to file reports on their foreign bank accounts. She and Margelus Burga, founder of the data storage design and manufacturing company Glide/Write USA, had hundreds of bank accounts between 2004 and 2009 in several countries for which they failed to file the reports, the government said.

According To The U.S., The Burgas Were Also Involved In

a False Invoicing Scheme At Glide/Write That Relied in Part

on A Liechtenstein Trust Their Financial Adviser, Peter Meier, Helped To Manage.

of The Documents, According To The Report,

But Has Said She Will Produce Any That He Provides.

Separately, Burga is challenging IRS deficiency notices issued to her as an individual and as administrator of her husband's estate in the U.S. Tax Court, according to the status report, maintaining that the notices moot the summons proceedings.

Contact the Tax Lawyers at

or Toll Free at 888-8TaxAid (888) 882-9243

Read more at: Tax Times blog