On April 26, 2022, we posted Should I Stay or Should I Go? - Expatriations Are Up In 1st Quarter of 2022, where we discussed that the number of people who expatriated from the U.S. rose during the first quarter of 2022 compared with the previous quarter, the Internal Revenue Service said in a notice released on July 25, 2022.

Now the number of people expatriated from the U.S. more than doubled during the second quarter of 2022 compared to the previous quarter, the Internal Revenue Service said in a notice released Wednesday.

The Number Of People Losing Or Renouncing Their U.S. Citizenship Rose To 1,473 In April Through June

The list includes those losing U.S. citizenship under Internal Revenue Code Section 877(a) and Section 877A , the notice said.

It also includes long-term residents who are treated as losing citizenship under IRC Section 877(e)(2), the agency said.

It also includes long-term residents who are treated as losing citizenship under IRC Section 877(e)(2), the agency said.

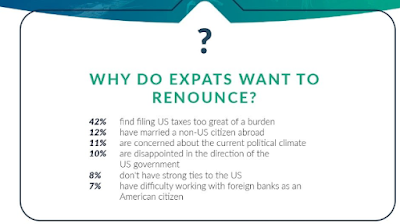

According to CNBC the top reason why Americans abroad want to dump their U.S. citizenship include:

- Nearly 1 in 4 American expatriates say they are “seriously considering” or “planning” to ditch their U.S. citizenship, a survey from Greenback Expat Tax Services finds.

- About 9 million U.S. citizens are living abroad, the U.S. Department of State estimates.

- More than 4 in 10 who would renounce citizenship say it’s due to the burden of filing U.S. taxes, the Greenback poll shows.

Should I Stay or Should I Go?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation contact us at:

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888-8TaxAid (888) 882-9243

or Toll Free at 888-8TaxAid (888) 882-9243

Read more at: Tax Times blog