On March 7, 2018 we posted 1st Taxpayer Victory in a "Willful" FBAR Penalty Case! where we discussed that on September 20, 2017, the Eastern District of Pennsylvania issued an important taxpayer friendly opinion regarding the "willfulness" standard in FBAR penalty matters.

In Bedrosian v. United States, Case No. 2:15-cv-05853-MMB (E.D. Pa., Sept. 20, 2017), the court held that the government had not met its burden in proving that Bedrosian had willfully violated FBAR reporting requirements. This opinion could have a major effect on future IRS decisions in the offshore compliance arena and may cause some taxpayers, to seek a more aggressive approach in addressing prior non-compliance.

However now according to Law360, The U.S. government has urged the Third Circuit to reverse a Pennsylvania federal judge’s decision to let a pharmaceutical CEO avoid a nearly $1 million tax penalty over an undisclosed Swiss bank account, arguing the lower court wrongly raised the bar for showing willful conduct.

However now according to Law360, The U.S. government has urged the Third Circuit to reverse a Pennsylvania federal judge’s decision to let a pharmaceutical CEO avoid a nearly $1 million tax penalty over an undisclosed Swiss bank account, arguing the lower court wrongly raised the bar for showing willful conduct.

U.S. District Judge Michael M. Baylson in September had found that Arthur Bedrosian, the CEO of generic drug maker Lannett Co., may have been negligent when he failed to report a Swiss bank account with UBS that held roughly $2 million to the Internal Revenue Service in a 2007 Foreign Bank and Financial Accounts form. However, Judge Baylson stopped short of concluding that Bedrosian willfully skirted the reporting requirements and accordingly ordered the government to return the 1 percent partial penalty payment he had made.

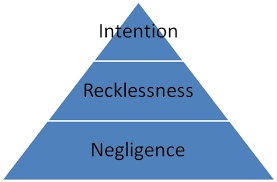

In pressing the Third Circuit to reverse and remand Judge Baylson’s decision, the government on said the willfulness standard in civil cases only required knowing or reckless conduct, not subjective bad intent. The district court strayed from this benchmark by not judging willfulness based on Bedrosian’s knowledge of his FBAR violation, but by his intent to do wrong, according to the government.

The question of whether a taxpayer willfully avoided filing an FBAR form, or just didn’t know about the reporting requirements, can make a substantial difference in the civil penalties the IRS ultimately assesses. In Bedrosian’s case, he was hit with a maximum penalty of nearly $1 million, or 50 percent of the undisclosed account.

After Bedrosian sued to claw back his nearly $10,000 partial penalty payment, the federal Zovernment lodged counterclaims for full payment of the penalty, plus interest.

Following a one-day bench trial, Judge Baylson on Sept. 20 found that the evidence against the CEO, including the inaccurate FBAR form itself and the fact that he may have known about the account he didn’t disclose, didn’t clear the bar to show a willful violation of reporting requirements.

The district court’s reliance on this and other cases as the minimum threshold for finding willfulness was an incorrect assumption, the government said Tuesday.

The district court compared Bedrosian’s conduct to situations where individuals used Swiss banks to carry out complex tax avoidance schemes, the government said, noting that Judge Baylson ultimately concluded that Bedrosian’s behavior was less “egregious,” and therefore not willful.

“The district court erred in concluding that because Bedrosian’s conduct was not as egregious as the conduct in those cases, he should not be liable for a willful FBAR penalty,” the government said.

According to court papers, after the accountant learned in the 1990s that Bedrosian had used the account since the early 1970s, he advised his client to ultimately “just leave it alone because the damage was already done” and that the situation would be resolved automatically one way or the other when Bedrosian died.

The government also noted that after Bedrosian’s accountant died, the CEO did not mention his Swiss bank account to his new accountant, who prepared a 2007 tax return and FBAR for Bedrosian, disclosing only the smaller of two UBS accounts, which had about $240,000 in it.

“Bedrosian professed to have simply signed and filed his FBAR notwithstanding that he had no idea how his accountant knew to prepare an FBAR or what it included, and notwithstanding that the filing constituted his first disclosure following decades of willfully violating the law,” the government said. “This cavalier disregard of his legal obligation to fully disclose his foreign accounts was reckless.”

Read more at: Tax Times blog