a Merry Christmas,

Happy Hanukkah and a

Happy and Prosperous New Year !

Tax Collections & Tax Planning

www.TaxAid.com

Read more at: Tax Times blog

December 11, 2017

Read more at: Tax Times blog

December 10, 2017

On December 2, 2017 we posted Senate Passes $1.4 Trillion Tax Cut Legislation where we discussed that the U.S. Senate passed an expansive tax cut bill early Saturday that is projected to add more than $1 trillion to the deficit, after garnering enough support from faltering and fiscally conservative Republicans.

On December 2, 2017 we posted Senate Passes $1.4 Trillion Tax Cut Legislation where we discussed that the U.S. Senate passed an expansive tax cut bill early Saturday that is projected to add more than $1 trillion to the deficit, after garnering enough support from faltering and fiscally conservative Republicans.

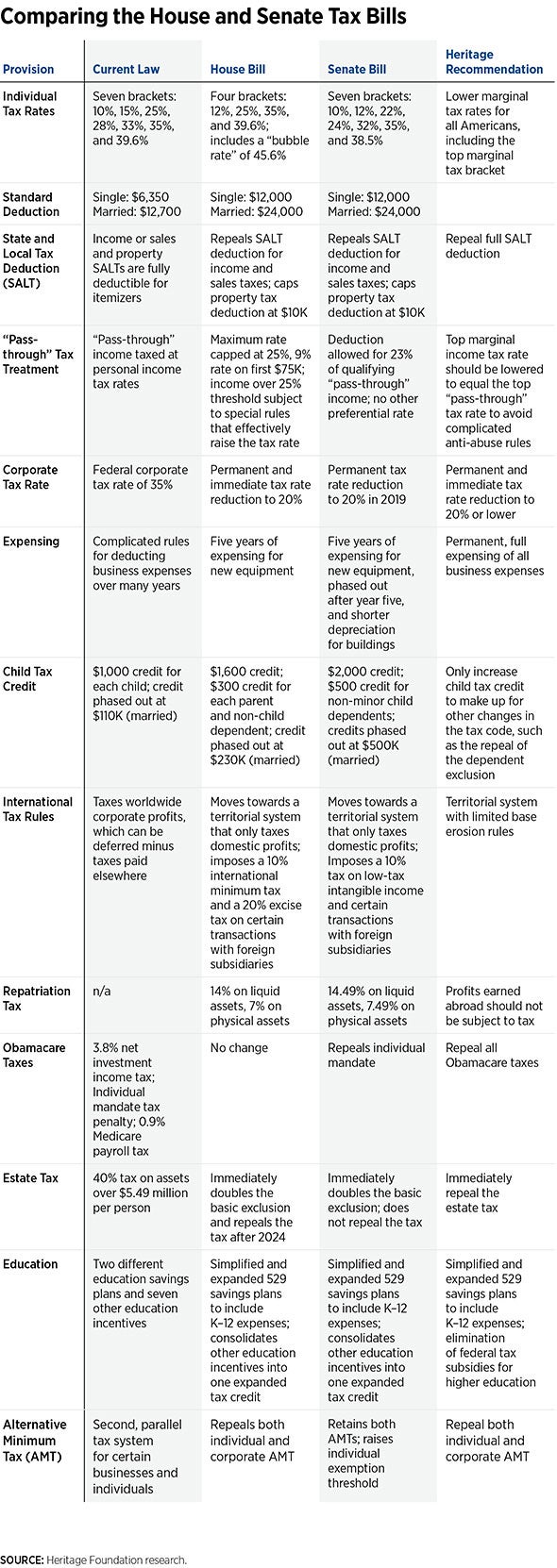

Now the Senate and the House have each passed their own version of the “Tax Cuts and Jobs Act.” The two versions of the bill have many similar provisions, but they also have a number of key differences that will have to be reconciled by the Conference Committee as the two bills are merged into a single piece of legislation.

It is unclear at this point how these differences will be resolved. However, there is generally an inclination that the Senate's provisions carry somewhat more weight because, since the Senate is subject to budgetary restraints as part of the reconciliation process, there is less flexibility to make changes to their bill.

The following are among the more significant differences between the two versions of the bill.

Sunset provision. The Senate bill, in order to comply with certain budgetary constraints, provided an expiration date of Jan. 1, 2026 for many of the tax breaks in its bill, especially those for individuals. The House, on the other hand, largely made the changes in its bill permanent.

Individual rates and brackets. The Senate bill has seven tax brackets for individuals with rates ranging from 10% to 38.5%. The House bill has four tax brackets ranging from 12% to 39.6%, retaining the top rate under current law.

Individual alternative minimum tax (AMT). The House bill would repeal AMT for individuals. The Senate bill would retain the individual AMT, with increases to the exemption amounts.

Estate tax. Both bills would significantly increase the estate and gift tax exemption, but the House would also repeal the estate tax after Dec. 31, 2024.

Individual mandate. The Senate bill would effectively repeal the individual mandate (i.e., by reducing the penalty amount to zero). The House version has no such provision.

Mortgage interest deduction. The Senate bill would leave the deduction for interest on acquisition indebtedness intact but would suspend the deduction for interest on home equity indebtedness. The House bill would allow the deduction for interest on acquisition indebtedness, but would, for newly purchased homes, reduce the current $1 million limitation to $500,000 ($250,000 for married individuals filing separately), and would allow the deduction only for interest on a taxpayer's principal residence. Interest on home equity indebtedness incurred after the effective date of the House bill would not be deductible.

Medical expense deduction. The House bill would repeal deductions for medical expenses under Code Sec. 213 outright, but the Senate bill would take a step in the opposite direction and temporarily (and retroactively) reduce the floor from 10% under current law to 7.5% for all taxpayers for tax years beginning after Dec. 31, 2016 and ending before Jan. 1, 2019, after which time the 10% floor would be scheduled to return.

Child tax credit. The Senate bill would increase the child tax credit from $1,000 under current law to $2,000, increase the age limit for a qualifying child by one year (for tax years beginning after Dec. 31, 2017 and before Jan. 1, 2025), increase the income level at which the credit phases out ($75,000 for single filers and $110,000 for joint filers under current law) to $500,000, and reduce the earned income threshold for the refundable portion of the credit from $3,000 to $2,500. The House bill would increase the amount of the credit to $1,600 and increase the income levels at which the credit phases out to $115,000 for single filers and $230,000 for joint filers.

Both bills would also provide a non-child dependent credit, which would be $500 under the Senate bill and $300 under the House bill. The House bill would also provide a “family flexibility credit”; the Senate bill has no equivalent.

Effective date of corporate tax reduction. Both bills would reduce the corporate tax rate to 20%, but the House's version would go into effect for tax years beginning after Dec. 31, 2017, whereas the Senate's version would go into effect for tax years beginning after Dec. 31, 2018.

Corporate AMT. The House bill would repeal the corporate AMT. The Senate bill, however, would retain the corporate AMT at its current 20% rate.

Section 179 expensing. Both bills would increase the expensing cap and phase-out under Code Sec. 179, but the Senate would increase the cap to $1 million and begin the phase-out at $2.5 million (up from $520,000 and $2,070,000 for 2018 under current law), whereas the House would increase the cap to $5 million and start the phase-out at $20 million.

Pass-through provision. The Senate bill would generally allow a non-corporate taxpayer who has qualified business income (QBI) from a partnership, S corporation, or sole proprietorship to claim a deduction equal to 23% of pass-through income. The House bill would provide a new maximum rate of 25% on the “business income” of individuals, with a series of complex anti-abuse rules to prevent the re-characterization of wages as business income.

Sources:

Read more at: Tax Times blog

December 4, 2017

According to DiazReus, as of December 2017, the United States Treasury Department’s Office of Foreign Asset Control (“OFAC”) will begin using an expanded version of the Magnitsky Act as a basis for applying sanctions to individuals and entities suspected of corruption related activities.

According to DiazReus, as of December 2017, the United States Treasury Department’s Office of Foreign Asset Control (“OFAC”) will begin using an expanded version of the Magnitsky Act as a basis for applying sanctions to individuals and entities suspected of corruption related activities. The Magnitsky Act, formally known as the Russia and Moldova Jackson–Vanik Repeal and Sergei Magnitsky Rule of Law Accountability Act of 2012, is a bipartisan bill passed by the U.S. Congress and signed by President Obama in November–December 2012, intending to punish Russian officials responsible for the death of Russian tax accountant Sergei Magnitsky in a Moscow prison in 2009.

December 2016, Congress enlarged the scope of the Magnitsky Act to address human rights abuses on a global scale. The current Global Magnitsky Act (GMA) allows the US Government to sanction corrupt government officials implicated in abuses anywhere in the world.

In September 2017, a group of NGOs and anti-corruption organizations identified fifteen international cases where alleged crimes were committed. Individuals from countries, including Azerbaijan, Bahrain, China, the Democratic Republic of the Congo, Egypt, Ethiopia, Liberia, Mexico, Panama, Russia, Saudi Arabia, Tajikistan, Ukraine, Uzbekistan, and Vietnam, were nominated for sanctions.

In early August 2017, Bill Richardson's Center for Global Engagement also identified a case where alleged crimes were committed in Bulgaria: nominated perpetrators include Bulgaria's General Prosecutor Sotir Tsatsarov and controversial media mogul and Member of Parliament Delyan Peevski.

OFAC will publish the names of these newly designated individuals and entities as it currently does with its Specially Designated Nationals and Blocked Persons List, and Specially Designated Narcotics Traffickers List.

The United States moves forward and is initiating its first prosecution. (Read Article in Spanish).

Have an International Business or Tax Issue?

Contact the Tax Lawyers at

Read more at: Tax Times blog

December 2, 2017

The Tax Cuts and Jobs Act, or H.R. 1, passed by a vote of 51-49, with Sen. Bob Corker, R-Tenn., being the only Republican to vote against the bill. No Democrats voted in favor of the bill.

President Donald Trump lauded the Republican leadership on Twitter.

The legislation, which still has to be reconciled with the version passed by the U.S. House of Representatives on Nov. 16, would permanently reduce the corporate tax rate to a flat 20 percent from the current 35 percent top rate, sunset individual tax cuts in 2026 and repeal the Affordable Care Act’s penalty for individuals who fail to purchase health insurance.

An early Friday amendment to the legislation, to win over Sens. Ron Johnson, R-Wis., and Steve Daines, R-Mont., would introduce a 23 percent deduction for pass-through businesses, which pass their income on to owners to be taxed at individual income tax rates. The deduction would bring the top effective tax rate for pass-through businesses to 29.6 percent from the current 39.6 percent.

Other significant changes made to the bill since it was first unveiled on Nov. 9 include an agreement that Sen. Jeff Flake, R-Ariz., struck with the GOP leadership to phase out full expensing for businesses during the last five years of the bill’s 10-year budget window instead of letting it expire it after five years, and amendments from Sen. Susan Collins, R-Maine, to deduct up to $10,000 in state and local property taxes, reduce the threshold for deducting medical expenses from 10 percent of income to 7.5 percent, and eliminate catch-up contributions to retirement accounts for employees at churches, schools and charities who earn less than their private-sector counterparts.

Another major change affecting multinational corporations, purportedly to help pay for the larger pass-through benefits, is an increase in the earlier proposed rates aimed at encouraging businesses to invest profits stashed overseas in the U.S. The new bifurcated repatriation rates are 14.5 percent for cash and 7.5 percent for illiquid assets, up from 10 percent and 5 percent, respectively, in the original Senate bill.

The Joint Committee on Taxation, Congress’ official nonpartisan scorekeeper of tax bills, released revenue effects of the last-minute modifications to the tax bill one hour after it was passed. Reinstating the corporate alternative minimum tax is forecast to provide an additional $40.3 billion of revenue over 10 years, while reinstating the individual alternative minimum tax with increased exemption amounts and phaseout thresholds would give the Republicans $132.9 billion to help close the revenue gap in the bill. The changes to the repatriation rates would also generate $113.3 billion.

Allowing deductions for state and local property taxes would cost approximately $148.4 billion and increasing the deduction for pass-through entities is estimated to cost an additional $114 billion over the next decade, according to the JCT.

The Tax Cuts and Jobs Act would also shift the U.S. to a territorial tax system, under which income earned abroad by U.S. parent corporations would not be taxed within the U.S.

The senators’ late-night session of voting on amendments resulted in a 29-71 rejection to a proposal from Sens. Marco Rubio, R-Fla., and Mike Lee, R-Utah, seeking a 20.94 percent corporate rate in exchange for making the child tax credit refundable. The nearly one percentage point difference in the corporate rate could have generated approximately $87 billion and made “a huge difference” to Americans earning between $20,000 and $50,000 annually, according to Rubio, who, along with Lee, ultimately did not to withdraw support for the bill.

A Thursday report from the JCT said the bill would produce only about 0.8 percent of GDP growth over 10 years and pay for just about a quarter of the cuts. The net cost of the bill would add $1 trillion to the deficit over 10 years, according to the JCT’s dynamic scoring.

While more than 80 percent of such taxpayers would see their taxes decrease by at least $500, significantly fewer than half of those making less than $50,000 would save at least $500 under the tax bill in 2019. For those earning less than $50,000, the bill would result in less than a $100 shift in their tax burdens, and in ten years from now, taxpayers earning less than $100,000 are more likely to see a tax increase or a decrease of less than $100, the JCT said.

Read more at: Tax Times blog