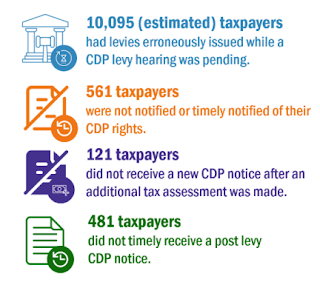

According to Report Number: 2023-30-066 TIGTA reviewed levies issued by the Automated Levy Programs for more than 2 million taxpayers during the period July 1, 2021, through June 30, 2022, and certain levies issued by revenue officers. TIGTA identified 11,258 instances of noncompliance that resulted in violations of taxpayers’ rights and taxpayers being burdened. TIGTA identified the following violations:

This is a significant number of CDP violations.

The majority (10,095) of the taxpayer rights violations occurred from the untimely input of taxpayers’ CDP levy hearing requests by Automated Collection System Support due to an unexpected large initial volume of requests following the July 2021 restart of the Automated Levy Programs. Levy CDP notices had been suspended during the Coronavirus Disease 2019 pandemic.

As a result, levies were issued while CDP hearings were pending, which is a violation of Internal Revenue Code § 6330. In addition, 561 taxpayers’ rights were violated when they were not notified or timely notified of their CDP rights, including 374 who were not notified due to errors in the Print to Correspondence Production Services pilot program that was initiated in December 2019.

TIGTA made nine recommendations to help improve the proper issuance of levies by the IRS, including that the IRS should periodically conduct a study of CDP levy hearing requests Form 12153, Request for a Collection Due Process or Equivalent Hearing. This will allow the IRS to determine the average time frame from when CDP levy hearing requests are received to when they are input into the CDP tracking system to determine a reasonable time frame to begin taking levy action against a taxpayer after they have been issued their CDP notice. IRS management agreed with eight of the recommendations and partially agreed with one recommendation.

Have An IRS Tax Problem?

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog