-

Trump Did Not Win the Election?

-

Obama-Care with its associated additional 3.8% Obama Care Tax make you feel like leaving the country?

-

You're so sick of liberal Democrats trying to socialize the United States by taxing wealthy people?

-

Or maybe you're a naturalized U.S. citizen or permanent resident who has prospered here, but would now like to move back the old country for retirement or to start a new venture?

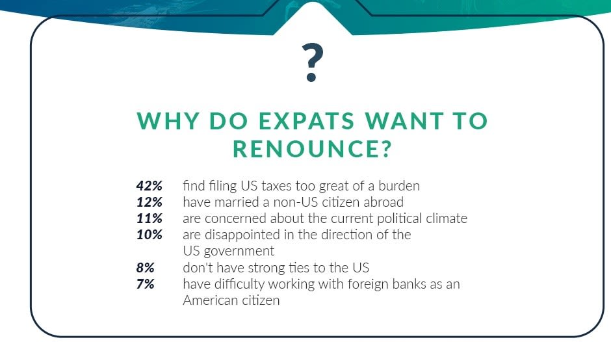

According to CNBC the top reason why Americans abroad want to dump their U.S. citizenship include:

- Nearly 1 in 4 American expatriates say they are “seriously considering” or “planning” to ditch their U.S. citizenship, a survey from Greenback Expat Tax Services finds.

- About 9 million U.S. citizens are living abroad, the U.S. Department of State estimates.

- More than 4 in 10 who would renounce citizenship say it’s due to the burden of filing U.S. taxes, the Greenback poll shows.

So Where Do Wealthy People Move To

When They Expatriate From The US?

According to Henley & Partners Japan has been knocked off the top spot on the Henley Passport Index for the first time in five years and bumped into 3rd place, according to the latest ranking published today as part of the Henley Global Mobility Report 2023 Q3.

Singapore Is Now Officially The Most Powerful Passport In

The World, With Its Citizens Able To Visit 192 Travel

Destinations Out Of 227 Around The World Visa-Free.

Far more than just a travel document that defines our freedom of movement, a strong passport also provides significant financial freedoms in terms of international investment and business opportunities.

Improving your economic mobility via investment migration gives you greater visa-free access to more stable economies and key markets that represent a higher proportion of the world’s GDP.

Should I Stay or Should I Go?

or Toll Free at 888-8TaxAid (888) 882-9243

Read more at: Tax Times blog