We originally posted on Monday, May 6, 2013,Whistleblower Exposes Massive Offshore Corruption!, where we discussed a whistleblower's

We originally posted on Monday, May 6, 2013,Whistleblower Exposes Massive Offshore Corruption!, where we discussed a whistleblower's release of information to the International Consortium of Investigative Journalists concerning off-shore holdings of people and companies in more than 170 countries and territories hiding trillions of dollars in income and assets.

Today the IRS announced in IR-2013-48, that the tax administrations from the United States, Australia and the United Kingdom plan to share tax information involving a multitude of trusts and companies holding assets on behalf of residents in jurisdictions throughout the world.

The three nations have each acquired a substantial amount of data revealing extensive use of such entities organized in a number of jurisdictions including Singapore, the British Virgin Islands, Cayman Islands and the Cook Islands. The data contains both the identities of the individual owners of these entities, as well as the advisors who assisted in establishing the entity structure.

The secret records are believed to include those obtained by the

International Consortium of Investigative Journalists that lay bare the individuals behind covert companies and private trusts in the British Virgin Islands, the Cook Islands, Singapore and other offshore hideaways.

The hoard of documents obtained by ICIJ represents the biggest stockpile of inside information about the offshore system ever gathered by a media organization.

The total size of the ICIJ files, measured in gigabytes, is more than 160 times larger than the leak of U.S. State Department documents by Wikileaks in 2010.

“The 400 gigabytes of data is still being analyzed but early results show the use of companies and trusts in a number of territories around the world including Singapore, the British Virgin Islands, the Cayman Islands and the Cook Islands,” the British tax office statement said.

The IRS, Australian Tax Office and HM Revenue & Customs have been working together to analyze this data and have uncovered information that may be relevant to tax administrations of other jurisdictions. Thus, they have developed a plan for sharing the data, as well as their preliminary analysis, if requested by those other tax administrations.

IRS Acting Commissioner Steven T. Miller stated that:

“This is part of a wider effort by the IRS and other

tax administrations to pursue international tax evasion.”

"Our cooperative work with the United Kingdom and

Australia reflects a bigger goal of leaving NO SAFE HAVEN

for people trying to illegally evade taxes.”

There is nothing illegal about holding assets through offshore entities; however, such offshore arrangements are often used to avoid or evade tax liabilities on income represented by the principal or on the income generated by the underlying assets.

In addition, ADVISORS may be subject to Civil Penalties or Criminal Prosecution for promoting such arrangements as a means to Avoid or Evade Tax Liability or Circumvent Information Reporting requirements.

It is expected that this multilateral cooperation and coordinated effort will allow many countries to efficiently process this information and effectively enforce any laws that may have been broken. Increasingly, tax administrations are working together in this way to assist one another in identifying non-compliance with the tax laws.

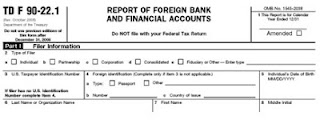

U.S. taxpayers holding assets through offshore entities are encouraged to review their tax obligations with respect to these holdings,

seek professional advice if necessary, and to participate in the

IRS Offshore Voluntary Disclosure Program where appropriate.

Failure to do so may result in significant penalties and possibly criminal prosecution!

Secret Foreign Investments Keeping You Awake at Night?

Want to get right with the IRS?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact US at

or Toll Free at 888-8TaxAid (888 882-9243).

Sources:

Assessments against business taxpayers that have not filed required tax returns have soared by nearly 60 percent according to the Treasury Inspector General for Tax Administration's (TIGTA) report dated September 17, 2012. However, the Internal Revenue Service needs to improve internal controls to ensure staff follow the correct procedures in documenting the reasons for these assessments, according to this report.

Assessments against business taxpayers that have not filed required tax returns have soared by nearly 60 percent according to the Treasury Inspector General for Tax Administration's (TIGTA) report dated September 17, 2012. However, the Internal Revenue Service needs to improve internal controls to ensure staff follow the correct procedures in documenting the reasons for these assessments, according to this report.