On February 2, 2021, we posted LB&I Extends The Suspension of IDR Enforcement Through June 30, 2021, where we discussed that

In a memo LB&I-04-1220-0021 (12/9/2020), the IRS's Large Business & International division (LB&I) has said it is extending the suspension of information document request (IDR) enforcement procedures as a result of COVID.On Friday, May 5, IRS Deputy Commissioner for Collection and Operations Support Darren Guillot announced at an American Bar Association tax conference panel in Washington, D.C.,

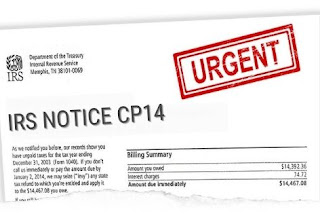

That The Pause On Certain Collection Notices

Will Stop This Month Following The Termination

Of The COVID-19 Emergency Declaration.

CP14 Notices inform taxpayers of outstanding balances of unpaid taxes, including the amount owed and a scannable QR code that directs to an IRS landing page for payments.

Guillot estimated by the "end of May,"

Approximately 5-8 Million CP14 Notices Will Be Sent To Taxpayers After A Suspension Dating Back

to 2020 at The Onset Of The Pandemic.

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog