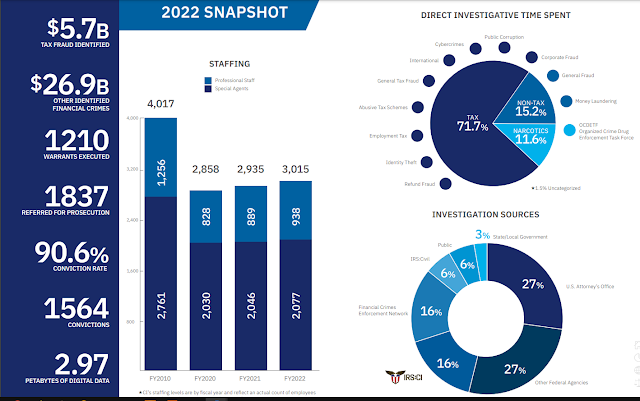

IRS-CI released its 2022 Annual Report on November 3, 2022 which details the agency’s work in fiscal year (FY) 2022.

The report noted that in FY 2022, CI’s special agents spent about 70% of their time investigating tax-related crimes like tax evasion and tax fraud and nearly 30% of their time was spent investigating money laundering and drug trafficking cases.

During their investigations, special agents identified over $31 billion from tax and financial crimes, and seized assets valued at approximately $7 billion.

CI also Had a 90.6% Conviction Rate on Prosecuted Cases.

Finally, the report includes case examples for each U.S. field office, an overview of IRS-CI’s international footprint, details about the specialized services provided by IRS-CI and investigative statistics, broken down by discipline.

Have an IRS Tax Problem?

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog