The IRS released its Data Book which presents information on collections and penalties resulting from individuals’ or entities’ failure to comply with the tax code. Failure to comply with filing, reporting and payment requirements may result in civil penalties or, in some cases, criminal investigation.

IRS’s Collection function collects Federal taxes that have been reported or assessed but not paid and secures tax returns that have not been filed.

Additionally, this section presents data on the IRS Independent Office of Appeals workload. The mission of Appeals is to resolve tax controversies without litigation, on a basis that is fair and impartial to both the taxpayer and the Federal Government.

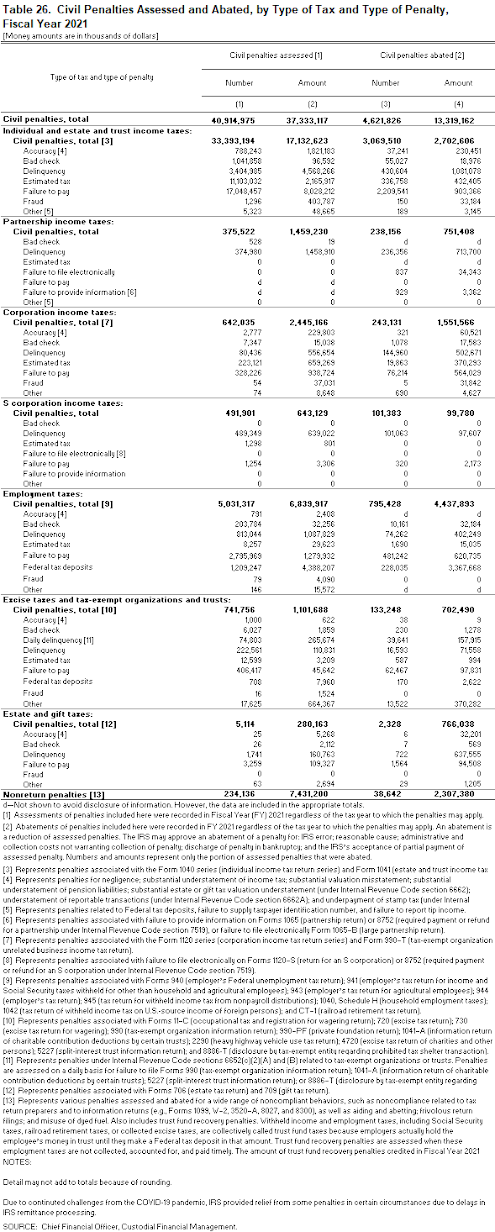

In Table 26 the IRS Presents Civil Penalties Assessed & Abated:

- In Fiscal Year (FY) 2021, the IRS collected more than $92.6 billion in unpaid assessments on returns filed with additional tax due, netting $59.5 billion after credit transfers (Table 25XLSX).

- The IRS assessed $37.3 billion in civil penalties in FY 2021. Of this, $17.1 billion was assessed in civil penalties on individual and estate and trust income tax returns (Table 26XLSX).

- During FY 2021, the IRS Appeals Office closed 66,522 cases, including those received in a prior fiscal year (Table 27XLSX).

Have an IRS Tax Problem?

Contact the Tax Lawyers at

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog