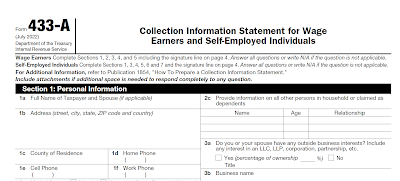

The Internal Revenue Service has updated Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, revised in July 2022.

What's new on Form 433-A in comparison with previous vision of May 2020?

1. New “Country” field has been added to many of the address lines:

· Taxpayer’s and Spouse’s address

· Employer’s address

· Car Loan Lender’s address

· Location of Personal Assets address

· Payment Processor’s address

· A/R customer address

· Location of Business Assets address

2. Under Employment Information field about number of exemptions claimed has been renamed to “Number of dependents claimed on your Form 1040”.

3. Under Other Information, questions about being a beneficiary of a trust, estate or life insurance policy and safe deposit boxes, have been clarified to include those located in foreign countries and jurisdictions.

4. Section “Virtual Currency (Cryptocurrency” is now renamed to “Digital Assets” and new types of assets have been added, such as Non-fungible token (NFT) and Smart Contract.

5. Under “Other Income” the IRS added description to include recurring capital gains form the sale of securities including cryptocurrency and non-fungible tokens. And the IRS clarified that income received through digital platforms (e.g. YouTube, TikTok, etc.) and income from providing on-demand work, services or goods (e.g. Uber, Lyft, Airbnb, VRBO) should be included as well. We disagree that some of the income the IRS classifies as Other Income should go under that line. Income from Uber, Lyft and Airbnb, for example, most frequently is reported on Schedule C and, therefore, would be disclosed under “Net Business Income” line.

If you use PitBullTax Software to prepare these forms, then they have updated the Form 433-A and their Questionnaire to include updates mentioned above.

Have an IRS Tax Problem?

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Source:

Read more at: Tax Times blog