The IRS made changes in April 2022 that will positively impact taxpayers who are submitting an Offer in Compromise to resolve their outstanding tax liabilities.

- These include revisions to the Collection Financial Standards that the IRS uses to determine a taxpayer's reasonable collection potential and

- Changes to the information and documentation a taxpayer must provide when applying for an Offer in Compromise.

Collection Financial Standards

The Collection Financial Standards set by the IRS are used to determine an individual taxpayer's necessary monthly expenses, based on the taxpayer's age, geographic location, and family size. These necessary expenses include food, clothing, housing and utilities, out-of-pocket healthcare, transportation, and other miscellaneous items.

The IRS Has Increased These Standards as of 4/25/2022 in an Effort To Relieve Some Pressure From Taxpayers Who Are Struggling To Cope With The 40-Year High Inflation Rate.

Struggling To Cope With The 40-Year High Inflation Rate.

This is great news for taxpayers with an outstanding tax liability with the IRS! These increases will help taxpayers who are seeking to enter into a Payment Arrangement or Offer in Compromise, with the IRS to resolve an outstanding tax liability.

The IRS also uses these Collection Financial Standards by comparing them to a taxpayer's household income and expenses, with the remaining amount considered as what the IRS will wants the taxpayer to remit each month.

Offer in Compromise

There are two big changes to the program:

- The first change is in relation to the IRS's traditional policy of keepin

g a taxpayer's tax refund through the year in which the taxpayer's Offer in Compromise is accepted. This means that if a taxpayer had an offer accepted in 2021 for a tax debt from 2018, the taxpayer would not see their 2021 refund. Now, however, the IRS will no longer adhere to this policy, and submitting an Offer in Compromise for a previous year will not jeopardize the taxpayer's current year's refund.

g a taxpayer's tax refund through the year in which the taxpayer's Offer in Compromise is accepted. This means that if a taxpayer had an offer accepted in 2021 for a tax debt from 2018, the taxpayer would not see their 2021 refund. Now, however, the IRS will no longer adhere to this policy, and submitting an Offer in Compromise for a previous year will not jeopardize the taxpayer's current year's refund. - The second change may require a taxpayer to submit much more information and documentation than what was previously necessary when submitting an Offer in Compromise. However, this only applies to taxpayers who have an ownership interest in a business.

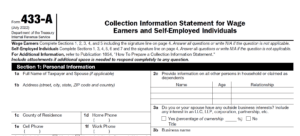

Previously, if a taxpayer had an ownership interest in a business but the taxpayer's tax debt was strictly personal (e.g., 1040 Income), the taxpayer need only submit Form 433-A (OIC), Form 656, and all relevant documentation. Now, that same taxpayer with the same personal tax liability must submit Form 433-B in addition to the other forms. This would require the taxpayer to provide the profit and loss information of the business for 6 to 12 months prior to submitting the Offer in Compromise, as well as the business's bank statements, loan statements, notes and accounts receivable, and other pertinent documentation.

Contact the Tax Lawyers at

Marini& Associates, P.A.

for a FREE Tax HELP Contact Us at:

www.TaxAid.com or www.OVDPLaw.com

orToll Free at 888-8TaxAid (888) 882-9243