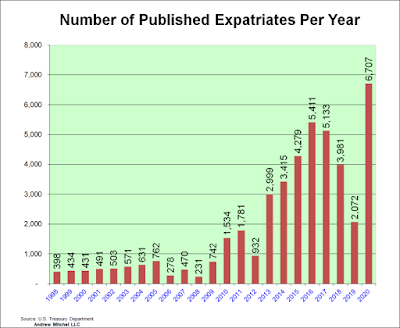

The Treasury Department published the 660 names of individuals who renounced their U.S. citizenship or terminated their long-term U.S. residency “Expatriated” during the 4th quarter of 2020, bringing the total number of published expatriates in 2020 to 6,707.

The latest U.S. Department of the Treasury Report reflects that a record 6,707 individuals expatriated during 2020.

Why are some Americans Individuals expatriating?

-

Trump Did Not Win the Election.

-

The Democrat's Now Control the House & the Senate.

-

Obama-Care with its associated additional 3.8% Obama Care Tax make you feel like leaving the country?

-

You're so sick of liberal Democrats trying to socialize the United States by taxing wealthy people?

-

Or maybe you're a naturalized U.S. citizen or permanent resident who has prospered here, but would now like to move back the old country for retirement or to start a new venture?

Whatever your motives, just because you leave the United States and renounce your citizenship, don't assume you can leave U.S. taxes (or U.S. tax forms and complexity) behind, particularly if you are financially well-off.

The increase in expatriation also has caught the attention of the Treasury Inspector General for Tax Administration (TIGTA), which, in a recent report, emphasized that the Internal Revenue Service (IRS) should have controls in place to better enforce U.S. tax and reporting provisions relating to expatriates.

On May 8, 2017, we posted Is it Time to Expatriate? Your Neighbors Are. where we discussed that the 2016 list of US expatriates’ shows an increase in the number of Americans who are renouncing their US citizenship or turning in their green card.

The graph above is based solely on IRS data and shows the number of published expatriates per year since 1998.

The connection between the list of expatriates and the IRS implies a link to tax policy.

The U.S. is one of a very small number of countries that tax based on nationality, not residency, leaving Americans living abroad to face double taxation.

The escalation of offshore penalties over the last 20 years is likely contributing to the increased incidence of expatriation.

In view of the significant uptick in expatriation activity, Marini & Associates has publish 3 Posts titled So Trump Did Not Win the Election - Is It Time to Expatriate? reviewing the essential elements of expatriation from a tax perspective.

Should I Stay or Should I Go?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation contact us at:

Toll Free at 888-8TaxAid (888) 882-9243

Read more at: Tax Times blog