According to Procedurally Taxing, in Polish Lottery Winner’s Son Sues Over Penalties For Failing To Report Foreign Gifts They discussed Wrzesinski v US. where the matter involved penalties under Section 6039F for failing to file Form 3520, the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

Krzysztof Wrzesinski emigrated to the US from Poland in 2005 at the age of 19. About five years later his mom, who still lived in Poland, won the Polish lottery. She took the proceeds and made gifts to Krzysztof of $830,000 over the course of 2010 and 2011.

While the proceeds were excluded from gross income, Krzysztof was hit with penalties in the amount of $87,500.00 and $120,000.00 for 2010 and 2011. Appeals abated much of those, but not about $45,000.

Krzysztof’s Tax Return Preparer Told Him (ADVICE) That He Need Not File Any Forms With His Tax Returns And That The Gift Proceeds Were Exempt From Gross Income.

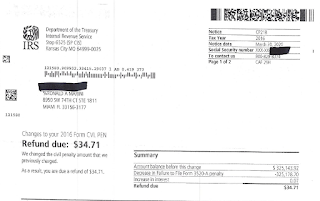

Last week DOJ has filed a status report indicating that it has conceded, and that Krzysztof will be receiving a refund in a couple of months.

Hat tip to Dan Price, who, in a post on Linked In, reasonably suggests that he hopes the concession will lead “IRS to acknowledge reasonable cause in more foreign gift penalty cases”.

Information Return Assessment?

Read more at: Tax Times blog