On July 21, 2023 we posted Shall I Stay or Shall I Go? - IRS Reports Nearly 55% Increase in US Expatriations In 2nd Quarter of 2023 where we discussed that he number of people expatriated from the United States rose nearly 55% during the second quarter of 2023 compared with the previous quarter, the Internal Revenue Service said in a published notice.

Now the Internal Revenue Service said in its notice that the number of people who expatriated from the U.S. jumped nearly 45% during the fourth quarter of 2023 compared with the previous quarter.

The Number Of People Losing Or Renouncing Their U.S. Citizenship Increased to 1145 For the 4th Qtr of 2023.

Included on the list are those who lost U.S. citizenship under Internal Revenue Code Section 877(a) and Section 877A, according to the notice, as well as long-term residents who are treated as losing citizenship under Section 877(e)(2).

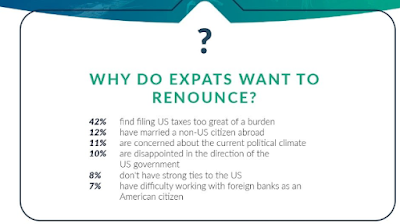

According to CNBC the top reason why Americans abroad want to dump their U.S. citizenship include:

- Nearly 1 in 4 American expatriates say they are “seriously considering” or “planning” to ditch their U.S. citizenship, a survey from Greenback Expat Tax Services finds.

- About 9 million U.S. citizens are living abroad, the U.S. Department of State estimates.

- More than 4 in 10 who would renounce citizenship say it’s due to the burden of filing U.S. taxes, the Greenback poll shows.

Should I Stay or Should I Go?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation contact us at:

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888-8TaxAid (888) 882-9243

or Toll Free at 888-8TaxAid (888) 882-9243

Read more at: Tax Times blog