According to Law360, Multinational companies moved an estimated 37% of profits, nearly $1 trillion, to so-called tax havens in 2019, according to a United Nations study.

The study, published Tuesday, called it a "remarkable" increase since 1975, when multinationals booked just 2% of profits in low-tax jurisdictions they were not headquartered in. The study was published by United Nations University, a U.N. think tank and postgraduate organization.

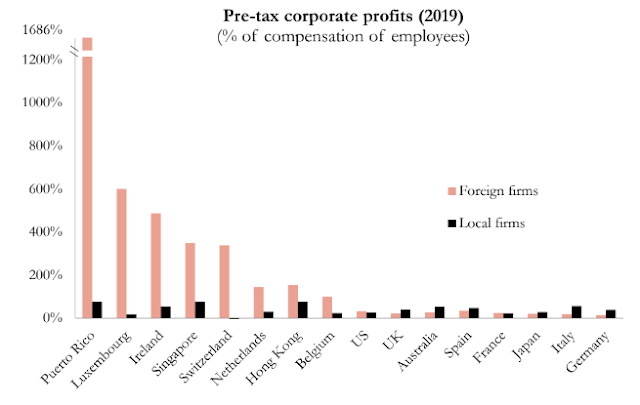

The study's authors defined tax havens as having "excessive profitability of foreign firms" and effective corporate tax rates of less than 15%. They said the growth of corporate profit shifting dovetailed with the increasing profitability of multinational enterprises.

These tax jurisdictions are Andorra, Anguilla, Antigua and Barbuda, Aruba, The Bahamas, Bahrain, Barbados, Belgium, Belize, Bermuda, the British Virgin Islands, the Cayman Islands, Cyprus, Gibraltar, Grenada, Guernsey, Hong Kong, Ireland, the Isle of Man, Jersey, Lebanon, Liechtenstein, Luxembourg, Macau, Malta, Marshall Islands, Mauritius, Monaco, Netherlands, the Netherlands Antilles, Panama, Puerto Rico, Samoa, Seychelles, Singapore, St. Kitts and Nevis, St. Lucia, St. Vincent &

One of the authors, Ludvig Wier, said in a news release that the findings of the study point to "a dire need for additional policy initiatives to significantly reduce global profit shifting," and called on countries to implement the globally agreed-upon deal for a 15% minimum corporate tax.

Read more at: Tax Times blog