On June 22, 2021 we posted Understanding IRS Tax Audits - Part I where we discussed that careful advance preparation can help reduce the scope of a tax audit or examination and can lead to a more favorable outcome. Although a thorough understanding of the underlying facts and applicable law is a must, understanding IRS procedures is critical to preserving a taxpayer’s rights.

On June 29, 2021 we posted Understanding IRS Tax Audits - Part II where we discussed when possible, the taxpayer’s representative, not the taxpayer, should interact with the agent. Indeed, in most cases, the meetings should take place at the representative’s office, not the taxpayer’s place of business. Direct contact between the agent and the taxpayer (or taxpayer’s employees) should be minimized.

Understanding IRS Tax Audits - Part III

We have summarize below and in Parts I & II some of the more important IRS procedural rules and guidelines governing civil IRS examinations and audits, including: how returns are selected for examination; a brief description of the types of civil examinations; an explanation of the tools available to IRS examining agents and revenue agents; dispositions in IRS audits or examinations and, if necessary, where to seek relief from an unfavorable result in an examination or audit.

Careful advance preparation can help reduce the scope of a tax audit or examination and can lead to a more favorable outcome. Although a thorough understanding of the underlying facts and applicable law is a must, understanding IRS procedures is critical to preserving a taxpayer’s rights.

Dealing with a Potential Criminal Referral If an agent has a “firm indication of fraud” he or she is required to suspend the civil examination without disclosing the reason to the taxpayer. IRS regulations prohibit an agent from developing a criminal case against a taxpayer under the guise of a civil investigation (but it happens all the time see Reverse Eggshell Audit Below). Then the agent must refer the case to the Criminal Investigation Division. The agent may be aware of potential fraud before he has enough evidence to suspend the exam and turn over the case. This is referred to as an eggshell audit which is a civil tax audit in which the taxpayer has filed a false tax return. If the falsity comes to light then there is possibility that the IRS can refer the case for criminal investigation, and ultimately criminal prosecution. Because of the sensitivity of the issues and the potential for disastrous results, anyone involved in the audit must walk on eggshells. Hence the term "eggshell audit.“ Take care to look for clues in the agent’s actions and behavior as to whether the nature of the case will shift to a criminal investigation. Among the tell tale signs that a civil case may be heading toward a criminal referral is the sudden cessation of communication with you by the agent; the agent asks the client “state of mind” questions usually starting with words like “why” and “didn’t you know" or the agent issues summons for otherwise closed tax periods, or summonses are issued for periods other than those contained in the original examination notice. Most importantly, look for the appearance of a “special agent”. A special agent is a federal law enforcement officer. He or she is required to identify himself as such and to give a Miranda-type warning. A special agent may arrive with the revenue agent or alone.

If an agent has a “firm indication of fraud” he or she is required to suspend the civil examination without disclosing the reason to the taxpayer. IRS regulations prohibit an agent from developing a criminal case against a taxpayer under the guise of a civil investigation (but it happens all the time see Reverse Eggshell Audit Below). Then the agent must refer the case to the Criminal Investigation Division. The agent may be aware of potential fraud before he has enough evidence to suspend the exam and turn over the case. This is referred to as an eggshell audit which is a civil tax audit in which the taxpayer has filed a false tax return. If the falsity comes to light then there is possibility that the IRS can refer the case for criminal investigation, and ultimately criminal prosecution. Because of the sensitivity of the issues and the potential for disastrous results, anyone involved in the audit must walk on eggshells. Hence the term "eggshell audit.“ Take care to look for clues in the agent’s actions and behavior as to whether the nature of the case will shift to a criminal investigation. Among the tell tale signs that a civil case may be heading toward a criminal referral is the sudden cessation of communication with you by the agent; the agent asks the client “state of mind” questions usually starting with words like “why” and “didn’t you know" or the agent issues summons for otherwise closed tax periods, or summonses are issued for periods other than those contained in the original examination notice. Most importantly, look for the appearance of a “special agent”. A special agent is a federal law enforcement officer. He or she is required to identify himself as such and to give a Miranda-type warning. A special agent may arrive with the revenue agent or alone.  Note that a special agent may make an unannounced visit to the taxpayer. The sole purpose of any such meeting is to catch the taxpayer off guard and without counsel, so that the client can incriminate himself. Because it is human nature to try to explain things, a taxpayer should be advised never to speak to a special agent without counsel present.

Note that a special agent may make an unannounced visit to the taxpayer. The sole purpose of any such meeting is to catch the taxpayer off guard and without counsel, so that the client can incriminate himself. Because it is human nature to try to explain things, a taxpayer should be advised never to speak to a special agent without counsel present.

If an examination becomes a criminal investigation, or if you think that the examining agent is heading in that direction, consider the following: terminating all direct contact between the taxpayer and the IRS, which I don't recommend under most circumstances; obtaining taxpayer records from third parties and holding them; advising the taxpayer to refrain from witness tampering and document creation or alteration.

Cooperation with the revenue agent will not save the day. If there is evidence of criminal conduct and that evidence is enough to obtain a conviction, there will be a referral, irrespective of how a taxpayer cooperates.

You also need to keep your eyes open for what is referred to as a "reverse eggshell audit." This is a tax audit in which IRS agent is collecting information for what purports to be a civil tax audit with the intent of providing that information to the IRS' criminal investigation division for criminal tax prosecution. It is the taxpayer who is unaware of the parallel or simultaneous criminal investigation.

Dispositions of Audits “Agreed” or “Unagreed”

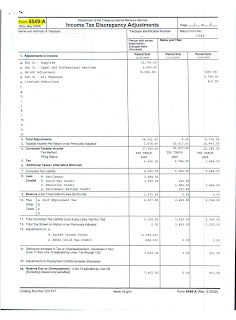

Audits may be concluded with an “agreed case” or an “unagreed case.” Of course, if the taxpayer presents sufficient documentation for the items at issue, the examining agent may accept the return as it was filed. If the taxpayer and the examining agent reach an agreement on adjustments, the taxpayer and examining agent complete a form describing the adjustments to the return and agreeing that any additional tax may be assessed.

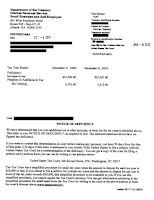

Where the taxpayer and the examining agent cannot reach an agreement, the examining agent’s next step will depend upon whether there is sufficient time remaining on the statute of limitations on assessment, generally six months. If there is sufficient time left on the statute of limitations, the examining agent will prepare a report that will be reviewed by the examining agent’s manager. Once approved, the report is sent to the taxpayer along with a “30-day letter”. If there is not sufficient time left on the statute of limitations and the taxpayer will not agree to extend the statute, the report will be sent to the taxpayer with a statutory notice of deficiency, sometimes referred to as a “90-day letter”.

A 30-day letter gives the taxpayer an opportunity to protest the examining agent’s proposed adjustments to an administrative appeals officer. The taxpayer has 30 days within which to submit a written protest outlining the taxpayer’s position on fact and law. Appeals officers are charged with evaluating the case ex parte based upon the record created by the revenue agent and as supplemented by the taxpayer. The appeals officer can uphold the examining agent; find for the taxpayer or attempt to reach a settlement with the taxpayer.

The appeals officer is instructed to consider the “hazards of litigation” for both sides in his or her evaluation of the case. If the case is agreed at this level, the parties will sign an agreement permitting the Service to assess and collect the agreed amounts. If the parties can not reach an agreement or if the taxpayer does not respond to the 30-day letter, the appeals officer will issue a statutory notice of deficiency.

The Service must issue a statutory notice of deficiency before it assesses additional tax. The Notice gives the taxpayer one last chance to contest the proposed deficiency prior to paying it. A taxpayer has 90 days to file a petition with the Tax Court to redetermine the deficiency.

If the taxpayer does not respond to the 90-day letter, the Service will assess the proposed deficiency and will issue a bill to the taxpayer. At this point, the taxpayer must pay the amount assessed. The taxpayer then has the opportunity to contest the assessment by filing a refund claim. If the refund claim is disallowed, the taxpayer may then file a refund suit in United States District Court or United States Court of Claims.

Statutes of Limitations

Statutes of Limitations

The Service does not have an unlimited time to examine a tax return. As a general rule, the IRS has a three-year statute of limitation to make an assessment of additional tax (i.e., the Service has only three years from the later of the due date of the return or the date the return was filed to assess a tax deficiency). (I.R.C. § 6501(a)). If no return was filed or, if filed, it was fraudulent, the statute of limitations is unlimited.( I.R.C. § 6501(c)). If the filed return omitted gross income representing more than 25% of that which was stated on the return, and no statement was attached to explain the omission, the statute of limitations is six years. (I.R.C. § 6501(e)). Then there is a special rule in the case of any information on foreign activities which is required under section 6038, 6038A, 6038B, 6038D, 6046, 6046A, or 6048 -Form 8938, the time for assessment of any tax shall not expire until 3 years after the date on which the IRS is furnished the information required to be reported.When no return was filed, the tax may be assessed at any time.

In certain circumstances, a taxpayer may agree to extend the statute of limitations. This is done in writing on IRS Form 872 (Consent to Extend the Time to Assess Tax) or 872-A (Special Consent to Extend the Time to Assess Tax).

A Form 872 extends the time to assess the tax to a specified date. A Form 872-A is a consent extending the period of limitations on assessment for an indefinite period of time. The consent given on Form 872-A can be revoked by filing a Form 872-T, which starts the running of the 90-day period for assessment of tax or issuance of a notice of deficiency.

Another special type of consent is a “Restricted Consent” which can be used to extend the statutory period of assessment with respect to specific restricted issues. The statute of limitations is allowed to expire with respect to all other issues.

Special statute of limitations rules also apply to tax returns on which a taxpayer failed to include any information required with respect to a “listed transaction” as defined by Code Section 6707A(c)(2). In such cases, the time for assessment does not expire before the date which is one year after the earlier of the date the information is furnished to the Service or the date a material advisor provides the identifying information to the Service.

The decision to extend the statute of limitations must be made carefully. Under certain circumstances, giving consent to extend the statute may benefit the taxpayer. For example, in an unagreed case, consent may be given so that the case can be considered by the appeals division. In other cases, extending a statute may simply provide the agent with additional time to identify and develop additional adjustments.

The IRS has broad authority to examine tax returns. An understanding of the rights and responsibilities of both taxpayers and the examining agent, can help reduce the scope of a tax audit or examination and can lead to a more favorable disposition. Hiring Experience Tax Counsel can also tilt the scales in your favor, in your effort to obtain a favorable resolution of your Tax Audit and your Tax Appeal.

Read more at: Tax Times blog