In United States v. Schwarzbaum (S.D. Fla. No. 18-cv-81147) a federal district court rejected an individual's claims that FBAR penalties assessed against him should be set aside because they were assessed after the limitations period expired.

Between 2006 and 2009, the taxpayer, Isac Schwarzbaum, maintained several foreign financial accounts, including accounts in Costa Rica and Switzerland. Isac did not file FBARs for his accounts in Switzerland before 2011.

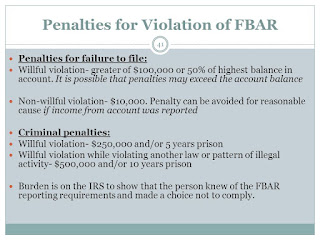

Isac then opted out of OVDI and underwent full examinations of his returns. After the examinations, the IRS decided to assert willful FBAR penalties against Isac. Those FBAR penalties (for tax years 2006-2009) were assessed in Sept. 2016.

- To the extent that Schwarzbaum argues that the penalties are time-barred, the argument lacks merit. Although Title 31 does not expressly authorize the extension of the applicable statute of limitations by agreement, it does not expressly prohibit such extensions. Schwarzbaum has failed to point to any legal authority indicating that such extensions would be improper. See Melford v. Kahane & Assocs., 371 F. Supp. 3d 1116, 1126 n.4 (S.D. Fla. 2019) (“Generally, a litigant who fails to press a point by supporting it with pertinent authority, or by showing why it is sound despite a lack of supporting authority or in the face of contrary authority, forfeits the point. The court will not do his research for him.”) (internal quotations and citation omitted).

- Notably, Schwarzbaum does not dispute that he signed consents agreeing to extend the time during which FBAR penalties could be assessed and collected. See ECF Nos. [44-5], [44-6], [44-7].

- Rather, in his Reply he acknowledges the lack of authority, argues that the USA relies upon three irrelevant cases in its Response, and then endeavors to distinguish them.

- However, Schwarzbaum ignores that it is he who bears the burden of establishing the defense of statute of limitations in the first instance. See, e.g. Feldman v. Comm’r of Internal Revenue, 20 F.3d 1128, 1132 (11th Cir. 1994) (“When a taxpayer raises the affirmative defense of the statute of limitations, the taxpayer bears the burden to prove that defense.”) (citation omitted).

- Here, Schwarzbaum has failed to provide any authority to support his argument that an agreement to extend the time to assess FBAR penalties under Title 31 is invalid.

Have Undeclared Income from an Offshore Bank Account?

Read more at: Tax Times blog