The Tax Court has concluded that a taxpayer wasn't entitled to a foreign earned income exclusion under Code Sec. 911(a) for the tax year at issue, because he failed to make a timely election under Reg. § 1.911-7(a)(2)(i), which provides that if the taxpayer is filing a late return and owes income tax after taking the exclusion into account, the taxpayer must attach the election to a Form 1040 filed before IRS discovers that the taxpayer has failed to elect the exclusion.

Redfield, TC Memo 2017-71

- A return that is timely filed (including any extension of time to file). (Reg. § 1.911-7(a)(2)(i)(A))

- A return amending a timely return, where the amended return is filed within the time prescribed for filing a claim for refund, generally three years from the return's due date. (Reg. § 1.911-7(a)(2)(i)(B))

- An original return that is filed within one year after the due date of the return (determined without regard to any extension of time to file). This one year period isn't an extension of time for any purpose—it's merely a period during which a valid election may be made on a late return. (Reg. § 1.911-7(a)(2)(i)(C))

- A return filed after the periods described in (1) through (3), above, but only if

- (a) the taxpayer owes no federal income tax after taking into account the exclusion (Reg. § 1.911-7(a)(2)(i)(D)(1)), or

- (b) the election is attached to a return filed before IRS discovers that the taxpayer failed to elect the exclusion. (Reg. § 1.911-7(a)(2)(i)(D)(2))

- (c) In either case, the taxpayer must type or legibly print at the top of the first page of the Form 1040 to which the election is attached, “Filed pursuant to Section 1.911-7(a)(2)(i)(D).” (Reg. § 1.911-7(a)(2)(i)(D)(3)).

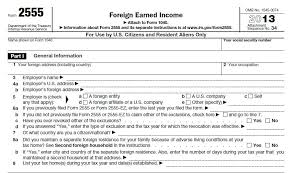

On Oct. 7, 2014, Mr. Redfield submitted to IRS a delinquent return for 2010 on which he reported wages of $240,211 and total income of $241,140. He included with the return Form 2555 on which he sought to exclude $49,136 of earnings from his work in Afghanistan. After giving effect to that exclusion, he reported $28,622 of tax, $22,510 of payments made, and $6,189 tax due.

IRS sent Mr. Redfield a second notice of deficiency, disallowing his claim for a foreign earned income exclusion because he had not elected to exclude foreign earned income on a prior return and had failed to make a valid election for 2010. That disallowance, along with certain computational adjustments, produced a deficiency of $15,982. IRS also determined late-filing and late-payment additions to tax under Code Sec. 6651(a)(1) and Code Sec. 6651(a)(2) and an accuracy-related penalty under Code Sec. 6662(a).

The taxpayer sought relief in the Tax Court.

While acknowledging the taxpayer's military service, and recognizing that the procedural requirements for making a timely foreign earned income exclusion weren't exactly intuitive and that the scars the taxpayer incurred during his military service may have contributed to the tax delinquency at issue, the Tax Court found that it had no alternative but to hold that Mr. Redfield did not make a timely and valid election for 2010. Accordingly, he was not entitled to exclude from gross income any foreign earnings under Code Sec. 911.

The Court noted that, Mr. Redfield did not follow the instruction set out in Reg. § 1.911-7(a)(2)(i)(D)(3) by typing or printing the specified statement at the top of the first page of the Form 1040.

The Court based then determined that the Reg. § 1.911-7(a)(2)(i)(D)(2) requirements had not been met and concluded that it did not need to decide whether this omission, standing alone, was sufficient to invalidate an otherwise timely foreign earned income exclusion election.

The Court also indicated that the facts of Mr.Redfield's situation (i.e., military service and injury) might be relevant to the penalty and additions to tax that IRS had determined, but they did not alter the requirement for a timely election under the regs.

The Court left for further proceedings IRS's determinations that the taxpayer was liable for late-filing and late-payment additions to tax under Code Sec. 6651(a)(1) and Code Sec. 6651(a)(2) and an accuracy-related penalty under Code Sec. 6662(a).

Read more at: Tax Times blog