According to the OECD, on 26-27 November, the 10th Anniversary Meeting of the Global Forum on Transparency and Exchange of Information for Tax Purposes (the Global Forum) in Paris will bring together more than 500 delegates from 131 member jurisdictions for renewed discussions on efforts to advance the tax transparency agenda.

|

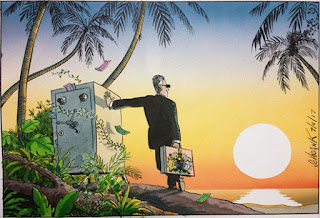

It Has Been Ten Years Since The G20 Declared The End Of Banking Secrecy, The International Community Has Achieved Unprecedented Success In Using New Transparency Standards To Fight Offshore Tax Evasion.

Working through the Global Forum, 158 member jurisdictions have implemented robust standards that have prompted a tidal shift in exchange of information for tax purposes. At the heart of this shift are thousands of bilateral exchange relationships now in place, which have enabled more than 250 000 information exchange requests over the past decade.

According to data in The Global Forum’s 10th anniversary report, in 2018 nearly 100 member jurisdictions automatically exchanged information on 47 million financial accounts, covering total assets of USD 4.9 trillion. In total, more than EUR 100 billion in additional tax revenue has been identified since 2009.

|

A recent OECD study shows that wider exchange of information driven by the Global Forum is associated with a global reduction in foreign-owned bank deposits in international financial centres (IFC) by 24% (USD 410 billion) between 2008 and 2019. The commencement of AEOI in 2017 and 2018 is associated with an average reduction in IFC bank deposits owned by non-IFC residents of 22%.

“The Global Forum has been a game-changer,” said OECD Secretary-General Angel Gurría. “Thanks to international co‑operation, tax authorities now have access to a huge trove of information that was previously beyond reach. Tax authorities are talking to each other and taxpayers are starting to understand that there’s nowhere left to hide. The benefits to the tax system’s fairness are enormous,” Mr Gurría said.

Almost all Global Forum members have eliminated bank secrecy for tax purposes, with nearly 70 jurisdictions changing their laws since 2009. Almost all members either forbid bearer shares– previously a longstanding impediment to tax compliance efforts – or ensure that the owners can be identified. Since 2017, members must also ensure transparency of the beneficial owners of legal entities, so these cannot be used to conceal ownership and evade tax.

Tax transparency is particularly important for developing countries. With support from the Global Forum, 85 developing country members have used exchange of information to strengthen their tax collection capacity. The Africa Initiative has helped African members identify over EUR 90 million in additional tax revenues in 2018, thanks to information exchanges and voluntary disclosures. To improve developing countries’ uptake of automatic exchange of financial information, the OECD-UNDP Tax Inspectors Without Borders Initiative today launched a pilot project aimed at supporting the effective use of the data.

Tax transparency is particularly important for developing countries. With support from the Global Forum, 85 developing country members have used exchange of information to strengthen their tax collection capacity. The Africa Initiative has helped African members identify over EUR 90 million in additional tax revenues in 2018, thanks to information exchanges and voluntary disclosures. To improve developing countries’ uptake of automatic exchange of financial information, the OECD-UNDP Tax Inspectors Without Borders Initiative today launched a pilot project aimed at supporting the effective use of the data.“There is still a lot of work ahead of us,” said Zayda Manatta, head of the Global Forum Secretariat. “Members must continue efforts to ensure full implementation of existing standards and address the tax transparency challenges of an increasingly integrated and digitalised global economy.”

Want To Know Which OVDP Program is Right for You?

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact us at:

or Toll Free at 888-8TaxAid (888 882-9243).

Read more at: Tax Times blog