The number of American taxpayers reporting foreign accounts to the Internal Revenue Service (IRS) doubled to 516,000 between 2007 and 2010, according to the US Congress' General Audit Office (GAO).

The GAO investigation also found that 6 per cent of US taxpayers who took up the IRS' 2009 offshore tax amnesty received penalties of USD1 million or more, and most of them had accounts at the Swiss bank UBS.

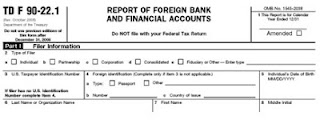

Have Un-Reported Income From A Foreign Bank?

Need Experienced Tax Advise?

Contact the Tax Lawyers at Marini & Associates, P.A.

for a FREE Tax Consultation Contact Us at:

www.TaxAid.us or www.TaxLaw.ms or

Toll Free at 888-8TaxAid (888 882-9243

Sources:

GAO statement

GAO Report (PDF file)

Read more at: Tax Times blog