The new program requiring the Internal Revenue Service to hire private debt collection agencies is falling far short of its goals and putting taxpayers at risk of falling prey to scammers, according to a new government report.

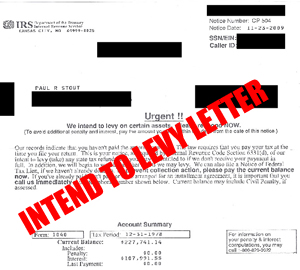

The report, from the Government Accountability Office, found that the IRS's private collectors recovered less than 2 percent of over $5 billion in debts. The GAO said the IRS's reports to Congress on the private debt collection program haven’t provided complete financial information either. For example, as of September 2018, the IRS reported program revenue collections of about $89 million and costs of $67 million, suggesting a positive balance of $22 million for the Treasury’s general fund. However, the GAO pointed out the IRS report didn’t clarify that approximately $51 million of the amount collected went to the Treasury and the remaining $38 million was retained by IRS in two special funds to pay for current and future program costs.

The GAO said the IRS also hasn't fully assessed the potential taxpayer risks in the program. The IRS has documented six risks, including "imposter scams," in which scammers pose as private collectors, but the GAO has identified 10 additional risks.

The current program is the result of legislation passed by Congress in 2015 with a provision requiring the IRS to set up another private debt collection program. The IRS eventually hired three contractors, and began assigning them cases in April 2017.

The current program is the result of legislation passed by Congress in 2015 with a provision requiring the IRS to set up another private debt collection program. The IRS eventually hired three contractors, and began assigning them cases in April 2017.

The GAO found that the IRS hasn’t analyzed the results of the program to identify the types of cases that should not be assigned to collection agencies because they do not result in collections.

The GAO's analysis of IRS data found that between April 2017 and September 2018 about 73,000 of 111,000 cases closed by collection agencies had little or no revenue collected because the collection agencies weren’t able to contact the taxpayer or collect the debt, among other reasons.

“Given the costs associated with managing these cases, without such analyses, the IRS may continue to use resources inefficiently and assign cases with little or no potential for revenue collection, or miss opportunities to assign other cases that could produce more revenue,” said the GAO.

The IRS has identified and taken steps to mitigate some of the program risks that could harm taxpayers, the GAO acknowledged. However, the service hasn’t yet completed the process of identifying and documenting all the risks, and has not fully assessed the risks to taxpayers from the program or its response to these risks.

An IRS official contended that the program has brought in significant revenue since the IRS began assigning cases in April 2017 to private collection agencies.

She also disagreed with the GAO’s contention that the IRS’s reports to Congress on the program had not provided complete financial information.

A group representing the private tax debt collectors also responded to the report. “The PCA’s welcome effective program oversight, have a strong compliance record, and are always looking for opportunities to improve as the IRS expands the successful Private Debt Collection Program,” said a statement from the Partnership for Tax Compliance. We would look forward to sitting down with GAO staff sometime soon to discuss the program’s proven success.”

Sources

Read more at: Tax Times blog