The Tax Court has held that, where a partner omits a partnership item from his individual tax return, and the partnership itself was subject to a TEFRA audit, the Court has jurisdiction to determine that partner's resulting negligence penalty.

The Tax Court's jurisdiction generally is limited to the review of deficiencies asserted by IRS (and not paid when the 90-day letter is issued). (Code Sec. 6512(a)).

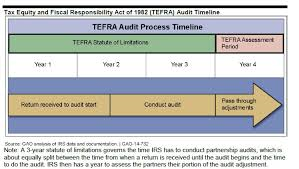

The following rules apply to TEFRA (i.e., the Tax Equity and Fiscal Responsibility Act of 1982) unified audit and litigation procedures. These procedures generally apply to partnership tax years that begin before January 1, 2018.

Whether a tax item of a partnership or a partner is a “partnership item” or a “non-partnership item” governs whether it is addressed in partnership-level proceedings or partner-level proceedings.

A partnership item is “any item required to be taken into account for the partnership's tax year under any provision of subtitle A to the extent the regs provide that, for purposes of this subtitle, such item is more appropriately determined at the partnership level than at the partner level.” (Code Sec. 6231(a)(3)) Non-partnership items are defined in the negative to be “an item which is (or is treated as) not a partnership item.” (Code Sec. 6231(a)(4))

Affected items are further divided into two subcategories: computational affected items and factual affected items.

- A computational affected item is one that can be determined mathematically, such as the medical expense deduction just described. (Code Sec. 6231(a)(6))

- A factual affected item is an affected item that requires further factual determinations at the partner level. (Hambrose Leasing 1984-5 Ltd. P'ship, (1992) 99 TC 298)

Whether an affected item is factual or computational generally determines what procedures apply to the assessment of tax relating to that item.

- Computational affected items are not subject to deficiency procedures. (Code Sec. 6230(a)(1)) Following a TEFRA proceeding, IRS may assess tax attributable to those items, along with the tax attributable to partnership items, by way of computational adjustment. (Code Sec. 6231(a)(6))

- In contrast, affected items that require partner-level factual determinations are subject to deficiency procedures. (Code Sec. 6230(a)(2)(A)(i)).

The taxpayers were Mr. and Mrs. Malone who filed a joint return. Mr. Malone was a partner in MBJ, a partnership. The partnership reported gain from installment sales of partnership assets.

The Malones did not report the gain on their joint return and didn't file a Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request, or otherwise notify IRS that they were taking a position inconsistent with that reported by MBJ.

IRS issued a notice of deficiency with respect to the unpaid taxes and the penalty for negligence.

The only issue before the Court was whether it had jurisdiction to determine the applicability of the negligence penalty. More specifically, the Court considered whether the deficiency procedures apply to a Code Sec. 6662(a) accuracy-related penalty for negligence imposed solely because of a partner's inconsistent reporting of partnership items.

Tax Court had jurisdiction with respect to negligence penalty. The Court held that, because there were no adjustments to partnership items, deficiency procedures applied to the penalty.

Read more at: Tax Times blog