The House passed the final version of the Republican tax bill on Wednesday December 20, 2017, capping off a furious seven-week push to bring about the most sweeping changes to the US tax code in decades.

However, President Donald Trump still needs to sign the bill, and he might not do so until the new year in order to avoid a massive $25 billion cut to Medicare.

The cut would come from the Pay As You Go Act, or PAYGO. The rule requires that any substantial increase in the deficit from a bill must be offset by reduced spending elsewhere. If no offsets are included in the bill, automatic cuts kick in when the deficit starts to grow.

The tax bill will add substantially to the deficit, around $1.5 trillion over 10 years, meaning that under PAYGO rules, an equal amount of spending must be cut to make up for the shortfall. According to a letter from the Congressional Budget Office, $150 billion a year would need to be slashed.

So we may have to wait for next year for president Donald Trump to sign this bill, taxpayers should not wait until next year to understand what's in this bill, especially since many of the provisions only applied to corporations or as corporations that were in existence as of December 31, 2017.

While not everything will be different if the Tax Cuts and Jobs Act (TCJA) is signed into law, understanding key changes from current law and how it may impact you will be important.

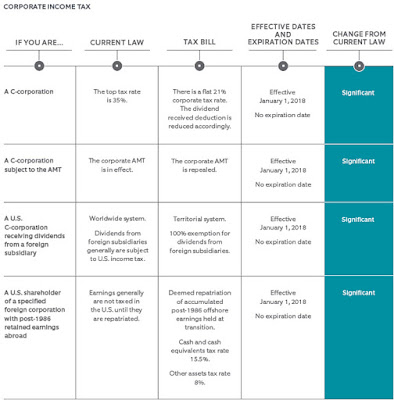

Northern Trust prepared a very simplified easy to understand chart regarding TAX REFORM -WHAT WILL THE LAW BE IN 2018? which summarizes current law and what the law will be beginning in 2018 when the Tax Cuts and Jobs Act is signed into law, with a view toward what matters most to you.

-

- Individual and corporate tax changes are effective January 1, 2018, but many individual provisions expire December 31, 2025.

-

- Estate, gift and generation-skipping transfer (“GST”) taxes remain in effect with double the basic exclusion and GST exemption amounts.

-

- Individual ordinary income tax rate reductions include lowering the top marginal rate to 37%, but the individual alternative minimum tax (“AMT”) remains in effect with a higher exclusion amount.

-

- Qualifying pass-through entity and sole proprietor business income for individuals (and estates and trusts) generally has a 20% deduction.

- Corporate income tax rates are reduced to 21% (from 35%) and the corporate AMT is repealed.

The tables provide a summary of the proposed legislation, organized in three parts:

-

- Estate, Gift and Generation-Skipping Transfer Taxes

-

- Individual and Pass-Through Business Income Tax

- Corporate Income Tax

-

US C Corporations receiving dividends from a foreign subsidiary will have a 100% exemption for the dividends it receives from a foreign subsidiary, effective January 1, 2018 and

-

There is a one time tax, to US shareholders of specified foreign corporation, on the amount of its previously untaxed offshore earnings which will be deemed to have been repatriated in 2018 and which will be subject to a 15.5% tax on the foreign corporations cash and cash equivalents and an 8% tax on the foreign corporations other assets.

-

After the US shareholder has pay tax on this deemed distribution in 2018, they then should be able to repatriate these earnings to the United States with no additional tax. In later years.

-

for a FREE Tax Consultation

Read more at: Tax Times blog