According to a BNA Daily Tax Report dated 05/31/2017 entitled Tax Prosecutions: Five Questions With Former DOJ Tax Head Caroline Ciraolo when asked "With the success of the Swiss Bank Program, have there been plans to announce a similar initiative?"

She respond by saying that when she left the DOJ earlier this year, the department wasn't planning to announce another offshore program. “A part of the reason was because of the Success of the Swiss Bank Program,” she said.

for Increased Enforcement.”

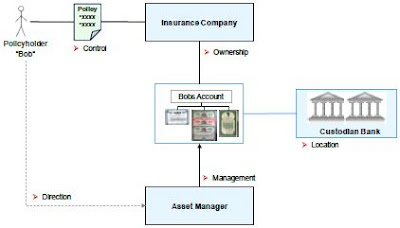

- Insurance wrappers are used for tax evasion purposes when an individual takes money from a foreign bank account and opens a life insurance policy with a partnering foreign insurance company.

- The account assets are then owned by the foreign insurance company, and not the individual taxpayer, who in many instances can still freely use the assets that should have been reported for purposes of the individual's U.S. tax liability.

Ciraolo said that the Creation and Use of

Foreign Entities, such as Foreign Insurance

Companies, to Shield the Identity of

U.S. Taxpayers has become an

Area of Focus for the Tax Division.

The statement of facts for every agreement from the program shows a pattern of misconduct that wasn't as public as it is today, she said, adding that the use of insurance wrappers was one example of U.S. taxpayers taking advantage of foreign entities.

Wrapper Met All of the

US Requirements?

Want to Know if the OVDP Program

is Right for You?

Read more at: Tax Times blog