A Los Angeles, California businessman was sentenced to 24 months in prison today for hiding more than $23.5 million in offshore bank accounts and evading more than $8.3 Million in Federal Taxes over seven years.

A Los Angeles, California businessman was sentenced to 24 months in prison today for hiding more than $23.5 million in offshore bank accounts and evading more than $8.3 Million in Federal Taxes over seven years.

For decades, with the assistance of at least two relationship managers from Bank Leumi and a second Israeli bank (Israeli Bank A), Sarshar hid tens of millions of dollars in assets in these accounts in an effort to conceal income and obstruct the Internal Revenue Service (IRS).

For decades, with the assistance of at least two relationship managers from Bank Leumi and a second Israeli bank (Israeli Bank A), Sarshar hid tens of millions of dollars in assets in these accounts in an effort to conceal income and obstruct the Internal Revenue Service (IRS).  Sarshar’s meetings with RM1 sometimes occurred in Sarshar’s car. RM1 and RM2 used their visits to offer Sarshar other bank products, including “back-to-back” loans. Through back-to-back loans, which Bank Leumi made to Sarshar through its branch in the United States and which Sarshar collateralized with funds from his account at Israeli Bank A, Sarshar was able to bring back to the United States approximately $19 million of his assets without creating a paper trail or otherwise disclosing the existence of the offshore accounts to U.S. authorities.

Sarshar’s meetings with RM1 sometimes occurred in Sarshar’s car. RM1 and RM2 used their visits to offer Sarshar other bank products, including “back-to-back” loans. Through back-to-back loans, which Bank Leumi made to Sarshar through its branch in the United States and which Sarshar collateralized with funds from his account at Israeli Bank A, Sarshar was able to bring back to the United States approximately $19 million of his assets without creating a paper trail or otherwise disclosing the existence of the offshore accounts to U.S. authorities. -

Serve three years of supervised release and

-

To pay more than $8.3 million in restitution to the IRS, plus interest and penalties.

-

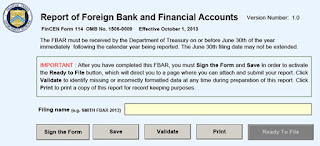

Sarshar also agreed to pay an FBAR penalty of more than $18.2 million for failing to report his Israeli bank accounts.

Want to Know if the OVDP Program is Right for You?

|

Read more at: Tax Times blog