According to Law360, for years, inertia has been Nitin Motwani’s greatest foe in his attempts to lure hedge fund owners in the northeast to Miami, which he has pitched as a tropical low-tax paradise. But with the Republican tax bill proposing to eliminate deductions for state and local taxes, he’s sensing an opportunity to finally overcome it.

Motwani, a Miami Downtown Development Authority board member, said the volume of requests for help with logistics — finding an attorney in Miami or a recommendation for an office broker — has increased since the tax bill began making its way through Congress. If the proposed changes to the tax code become law, it could be the final incentive that could trigger a flow of hedge funds from high-tax areas like New York and Connecticut to South Florida.

“We’ve always had good weather and good taxes, but this tax change provides another incentive,” Motwani said. “Inertia can be a dangerous thing — it’s just easy to stay put. But you add one more reason to rethink it, and then people are looking at it with a fresh set of eyes.”

Motwani is in charge of the initiative at the DDA aimed at trying to lure fund managers to Miami, which ramped up recently through a formal partnership with the Hedge Fund Association announced in August. The two organizations will host a private event Friday at the Perez Art Museum Miami during Art Basel, the annual art exhibition that draws thousands of visitors to Miami in early December.

The plan is to educate attendees about what he calls the “new Miami.”

“Lots of people think they know Miami because they come down for a weekend of fun in the sun,” he said. But the story of the city is one not just of beaches and sunshine but also of a sophisticated financial market in an international gateway city with a growing number of cultural institutions like the Perez museum, he said.

And as the GOP tax bill inches closer to passage, many hedge fund managers are taking a harder look at the Magic City.

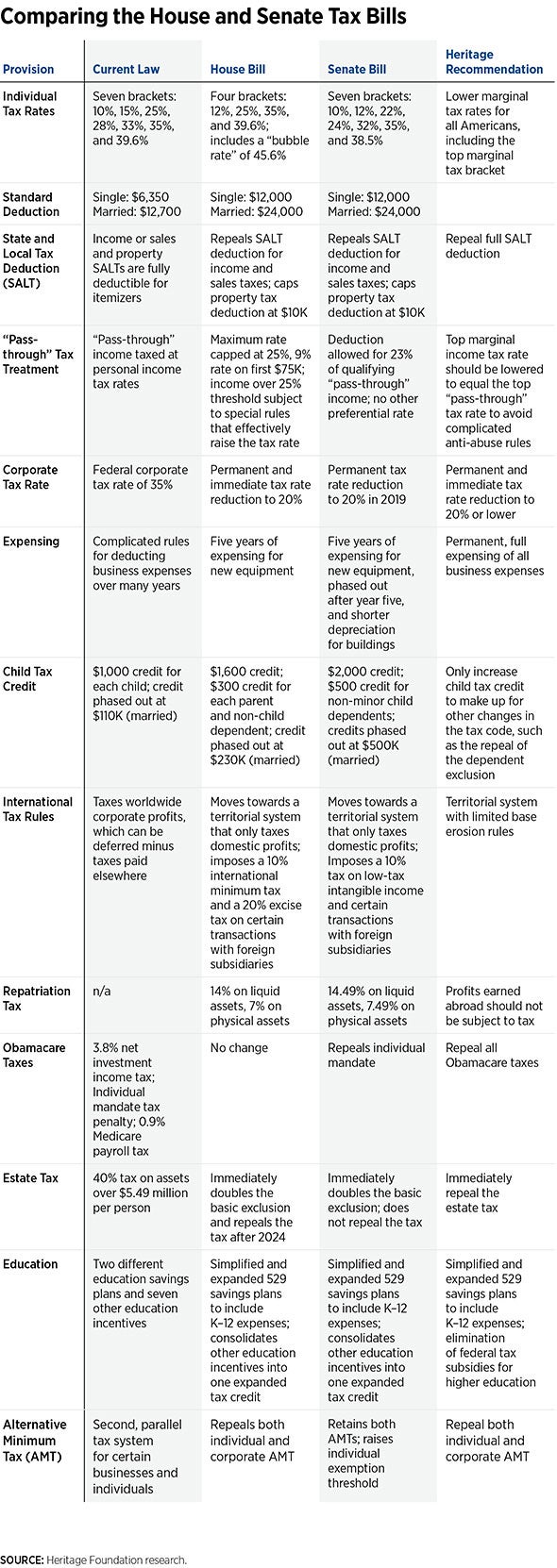

Both the House and Senate versions of the tax legislation would remove almost all deductions for state and local taxes, which would hurt high-income taxpayers in high-tax states the hardest. The only deduction to survive the process so far is one for up to $10,000 in property taxes.

From the outset of the tax debate, the notion of changing state and local tax deductibility has been one of the most contested aspects of the process, with opponents arguing that it would not only take away a core tenet of the tax code that has stood for 100 years but also disproportionately impact high-tax states such as New York, New Jersey and California.

But for states with no income tax, like Florida, it could be a boon, and Miami’s boosters argue it’s better positioned than other cities to support the alternative investment industry. The city is an international gateway, has multilingual talent available and is an investment hotspot for wealthy Latin Americans looking to park their money in the United States. And with more Class A office space going up in Miami’s financial center of Brickell, the city now has the physical infrastructure to support these firms, according to Hedge Fund Association president Mitch Ackles.

The money flowing in from Latin America has made a huge impact in the growth of Miami’s financial community, according to Tom Krasner, who co-founded Concise Capital Management in 2003.

Krasner has seen a number of managers opening offices in the city, though not moving their headquarters because of the difficulty in relocating an entire operation. Efforts by organizations like the DDA and the Miami City Commission have been helpful, but he said what is really making a difference in attracting fund managers is the transformation of the city in the last two decades.

The funds Ackles said are ripe for plucking from northern climes are the smaller, emerging funds in their early stages, before they become established and loath to move. He added that with the advent of companies that allow hedge funds to outsource their investor relations and paperwork, many smaller funds can stay lean, meaning there are fewer people to transplant.

Read more at: Tax Times blog