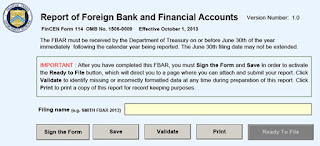

On February 22, 2017 we posted Your FBAR Is Due in April This Year! where we discussed that the new law, for returns for tax years beginning after Dec. 31, 2015, the due date of FinCEN Report 114 will be Apr. 15, with a maximum extension of 6 months ending on Oct. 15.

Now FinCEN has issued a new report providing that while new annual due date for filing Reports of Foreign Bank and Financial Accounts (FBAR) for foreign financial accounts is April 15; to implement the statute with minimal burden to the public and FinCEN, FinCEN will grant filers failing to meet the FBAR annual due date of April 15 an automatic extension to October 15 each year.

Accordingly, specific requests for this extension are not required. You will not have to file any paperwork with the Department to file Form 114 by October 15.

If you have foreign bank or investment accounts, make sure to discuss this with your tax advisor.

If you have not reported these accounts, you may need to go back six or eight years and voluntarily report it to the Department of Treasury and the IRS. Their is a 325% tax, penalties & interest for not doing this,which can easily exceed the remaining dollars in those accounts.

Read more at: Tax Times blog