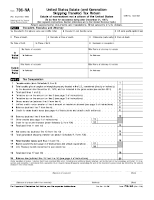

For those of you whose practice involves international tax, I would like to take this opportunity to explain the deceptive simplicity of the form 706 NA.

You must have a client who is a nonresident alien who dies. He/she owns US situs assets so you look at section 2014 of the Internal Revenue Code; you correctly determine that since these assets exceed $60,000 in value, the estate is required to file a form 706NA which is the form analogous to a 706 in the hands of a nonresident alien. The form itself is deceptively simple-two pages-what kind of problems can this create? Once you start reading the form, you realize that to complete it properly, you may have to incorporate almost every schedule which appears in a 706.

The deceptive part of the form occurs when you are trying to determine which of decedent’s US assets (based on section 2014) are taxable by the United States.

The United States has more than 20 tax treaties or conventions with foreign countries designed, for the most part, to eliminate double taxation. It is critically important for you, the preparer, to determine which, if any, treaties may exist to reduce the tax liability of your client.

The IRS, on its website, has a list of the countries which currently share estate tax treaties/conventions with the United States. Even this provides only a partial clue.

Example- You have a client who was a German who lived in Brazil. Since the decedent was a German citizen, you make the assumption that treaty benefits will be available to his/her estate. Not always so. Some of the treaties base their benefits on decedents who are domiciliaries of but not necessarily citizens of a particular country. Ergo, you learn that the estate of the German client domiciled in Brazil cannot utilize the benefit of the German treaty.

Additionally, since some treaties are predicated on domicile while others are predicated on both domicile and citizenship, you may find yourself in an anomalous situation where you have more than one treaty you can elect to apply. In this particular case, use the treaty which best suits your client.

As a rule, the 20 or so treaties are generally address estates of decedents who were citizens of Europe, England or Canada. There are no treaties with South or Central America or Africa. Remember, however, that some treaties are based on citizenship, not domicile. Therefore the estate of an English citizen domiciled in Sudan could benefit by the UK tax convention.

The benefits as well as the applications of the treaties very widely. This is a result of the fact that these treaties were negotiated over various periods of years from the 1950s to the year 2000. The treaties themselves must be read carefully. They are, for the most part, extremely poorly drafted and difficult to fathom. In the case of confusion, look up the meaning of what the treaty means in a publication called the technical explanations of treaties which are a little bit better written but still no works of Shakespeare. Remember, if you fail to utilize an existing treaty and it costs your client a significant amount of money, you may become involved with your insurance carrier. For those of us who are attorneys, remember the hornbook, Prosser On Torts. As I recall, and it's been a while, the first topic addressed is “negligence, the basis of liability”. If you fail to find and utilize an existing treaty, you are negligent and potentially headed for big trouble.

Some of you feel that the IRS will find incorrect your failure to utilize an estate tax treaty. Not so. First of all, not all estate tax returns are selected for examination, so if the return you filed failing to utilize a treaty is not examined, there is no way that treaty benefits will inure your to your client's estate. Second, even if the estate is examined, it is not the job of the auditing attorney to tell you that you failed to utilize a treaty. Utilization of a treaty is not mandatory. Therefore, if you file the 706NA utilizing the situs rules of section 2014, the IRS agent will merely agree with your situs depiction and not discuss the availability of the treaty.

If you feel that you are able to utilize one of the existing treaties, you are required to use a form 8833. In this form you explain which treaty you are using, why you feel it is applicable to your particular situation, and determine the treaty benefits of utilizing the treaty.

If you feel that you are able to utilize one of the existing treaties, you are required to use a form 8833. In this form you explain which treaty you are using, why you feel it is applicable to your particular situation, and determine the treaty benefits of utilizing the treaty.

Over my 32 years as a senior attorney with the IRS in the international estate tax forum, I audited perhaps 1,800 to 2,000 706 NA's. Utilization of the treaty benefit was not frequent, and I recall situations where some estates could have benefited to the tune of roughly $1 million in tax savings.

Need Help Preparing Form 706 NA?

Estate Tax Problems Require

an Experienced Estate Tax Attorney

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact US at

or Toll Free at 888-8TaxAid (888 882-9243).

-------------------------------------------------------------------------------------------

Robert S. Blumenfeld -

Robert S. Blumenfeld - Estate Tax Counsel

Mr. Blumenfeld concentrates his practice in the areas of International Tax and Estate Planning, Probate Law, and Representation of Resident and Non-Resident Aliens before the IRS.

Prior to joining Marini & Associates, P.A., he spent 32 years as the Senior Attorney with the Internal Revenue Service (IRS), Office of Deputy Commissioner, International.

While with the IRS, he examined approximately 2,000 Estate Tax Returns and litigated various international and tax issues associated with these returns.As a result of his experience, he has extensive knowledge of the issues associated with and the preparation of U.S. Estate Tax Returns for Resident and Non-Resident Aliens, Gift Tax Returns, Form 706QDT and Qualified Domestic Trusts.

The Tax Court has concluded that for the years at issue (2007 - 2010), the earnings and profits (E&P) of the upper tier controlled foreign corporation (CFC) partner of a domestic partnership had to be increased as a result of the partnership's Code Sec. 951(a) income inclusions. (Eaton Corporation and Subsidiaries, (2019) 152 TC No. 2).

The Tax Court has concluded that for the years at issue (2007 - 2010), the earnings and profits (E&P) of the upper tier controlled foreign corporation (CFC) partner of a domestic partnership had to be increased as a result of the partnership's Code Sec. 951(a) income inclusions. (Eaton Corporation and Subsidiaries, (2019) 152 TC No. 2).

Generally speaking, a controlled foreign corporation (CFC) that is a partner in a domestic partnership must include in gross income its distributive share of that partnership's gross income, including income that the partnership included under section 951(a) with respect to any lower tier CFCs. According to respondent the upper tier CFC partners must also increase their earnings and profits (E&P) by such an amount. Adopting that approach, respondent contends that the correct amounts to be included in petitioner's gross income under sections 951 and 956 are $73,030,810 and $114,065,635 for tax years 2007 and 2008, respectively.

Generally speaking, a controlled foreign corporation (CFC) that is a partner in a domestic partnership must include in gross income its distributive share of that partnership's gross income, including income that the partnership included under section 951(a) with respect to any lower tier CFCs. According to respondent the upper tier CFC partners must also increase their earnings and profits (E&P) by such an amount. Adopting that approach, respondent contends that the correct amounts to be included in petitioner's gross income under sections 951 and 956 are $73,030,810 and $114,065,635 for tax years 2007 and 2008, respectively.