T he Tax Court has found that an IRS settlement officer (SO) abused his discretion in sustaining a proposed levy to collect unpaid trust fund recovery penalties (TFRPs) after the taxpayer's offer in compromise (OIC) had been terminated due to default. The court remanded the case for determination of whether the OIC had been properly terminated.

he Tax Court has found that an IRS settlement officer (SO) abused his discretion in sustaining a proposed levy to collect unpaid trust fund recovery penalties (TFRPs) after the taxpayer's offer in compromise (OIC) had been terminated due to default. The court remanded the case for determination of whether the OIC had been properly terminated.

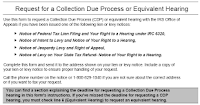

Judicial review of a Collection Due Process (CDP) hearing is limited to the administrative record. (Kreit Mech. Assocs., Inc., (137 TC 123 (2011)) The reviewing court determines whether the SO exercised his discretion arbitrarily, capriciously, or without sound basis in fact or law. (140 TC 173 (2013)). An SO abuses his discretion if, among other things, he does not properly verify that the requirements of any applicable law or administrative procedure have been met. (Reg. §301.6330-1(e))

When IRS determines that an OIC is in default, it is required to send the taxpayer a default letter to cure the noncompliance items. If the taxpayer does not cure the default, the OIC is terminated. (IRM 8.22.7.10.8(1) (August 9, 2017)).

The taxpayer was president of a corporation that failed to pay employment taxes for two tax periods in 2003 and two periods in 2004. An IRS settlement officer (SO) determined that the taxpayer had signatory authority over the corporation's bank accounts and was a responsible officer for the nonpayment of its employment tax liabilities.

The SO made two assessments covering the periods at issue for trust fund recovery penalties (TFRP). The taxpayer submitted a Form 656, Offer in Compromise (OIC), and offered to compromise the liability of the corporation. An IRS Appeals office in Sacramento, California, accepted the OIC on April 27, 2010, and noted in the acceptance letter the conditions on which the OIC would be accepted, including payment of all required taxes for five years or until the offered amount was paid in full, whichever was longer. IRS later notified the taxpayer that he had met the payment provisions of his OIC and began processing the relevant lien releases.

The taxpayer paid his income taxes, along with late penalties and interest, for tax years 2010 through 2012.

In December 2012, IRS issued a notice of proposed changes, to which the taxpayer did not respond, followed by a notice of deficiency in May 2013 based on the taxpayer's omission of certain unemployment compensation from income for 2010.

The taxpayer did not respond to the notice of deficiency, and IRS in September 2013 made a default assessment of tax, penalties, and interest. The taxpayer did not receive these notices because he had changed his residence but had not notified IRS of change of address.

The taxpayer could avoid default by payment of his liabilities by January 2, 2014. In 2014, the Brookhaven Appeals office terminated the taxpayer's OIC and reinstated the TFRP penalties, minus payment already made by the taxpayer, due to failure to pay the amounts due by the January 2, 2014 deadline.

However, the record did not reflect a written communication to the taxpayer informing him of a default on the OIC, requesting that he contact IRS, or setting a January 2, 2014 deadline to respond or pay the amount due (default letter).

The SO held a telephone CDP hearing with the taxpayer's representative on February 11, 2016. The SO refused to reinstate the OIC and issued a notice of determination sustaining the proposed levy.

In August 2017, IRS moved to remand the case to the Appeals Office for a supplemental CDP hearing to consider a new OIC as a collection alternative, based on the fact that the SO had not provided the taxpayer with a Form 656, or set a deadline for submission of a new OIC.

In August 2017, IRS moved to remand the case to the Appeals Office for a supplemental CDP hearing to consider a new OIC as a collection alternative, based on the fact that the SO had not provided the taxpayer with a Form 656, or set a deadline for submission of a new OIC. The court granted the motion to remand. At the supplemental telephone CDP hearing in November 2017, the taxpayer's representative indicated that the taxpayer was not prepared to submit a new OIC at that time. The SO found that the Brookhaven IRS office had followed all procedures in notifying the taxpayer before termination of the OIC. Because the termination was upheld by Appeals in January 2014, the SO determined that the taxpayer could not challenge the termination of the OIC.

The taxpayer petitioned the Tax Court. At trial, the taxpayer did not present any evidence or argument as to any collection alternatives other than reinstatement of the original OIC.

The Tax Court determined that the taxpayer had not filed a change of address form and so was responsible for his failure to receive the notices of change, deficiency, and levy.

However, IRS was required to send the taxpayer a default letter and give him an opportunity to cure the default. The SO was required to verify that the Brookhaven office had sent the taxpayer a default letter. The administrative record did not support IRS's contention that a default letter had been sent.

Neither the notice of change letter nor the notice of deficiency that were sent to the taxpayer warned him of potential termination of the OIC, set a deadline for default, or informed him of an opportunity to cure the default.

Therefore, the determination to sustain the proposed levy was an abuse of discretion, and the case was remanded for the SO to consider whether the OIC was properly terminated, and, if not, whether the terminated OIC should be reinstated as a collection alternative.

The court also suggested that a new SO be appointed.

Have A Tax Problem?

Contact the Tax Lawyers at Marini& Associates, P.A.

for a FREE Tax HELP Contact Us at:

orToll Free at 888-8TaxAid (888) 882-9243

he Tax Court has found that an IRS settlement officer (SO) abused his discretion in sustaining a proposed levy to collect unpaid trust fund recovery penalties (TFRPs) after the taxpayer's offer in compromise (OIC) had been terminated due to default. The court remanded the case for determination of whether the OIC had been properly terminated.

he Tax Court has found that an IRS settlement officer (SO) abused his discretion in sustaining a proposed levy to collect unpaid trust fund recovery penalties (TFRPs) after the taxpayer's offer in compromise (OIC) had been terminated due to default. The court remanded the case for determination of whether the OIC had been properly terminated. In August 2017, IRS moved to remand the case to the Appeals Office for a supplemental CDP hearing to consider a new OIC as a collection alternative, based on the fact that the SO had not provided the taxpayer with a Form 656, or set a deadline for submission of a new OIC.

In August 2017, IRS moved to remand the case to the Appeals Office for a supplemental CDP hearing to consider a new OIC as a collection alternative, based on the fact that the SO had not provided the taxpayer with a Form 656, or set a deadline for submission of a new OIC.