According to Law360, interests in some foreign accounts holding digital assets such as cryptocurrency would have to be disclosed to the Internal Revenue Service under a proposal put forth Monday by the U.S. Department of the Treasury.

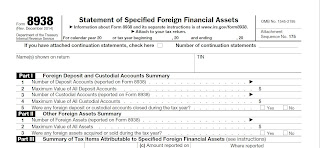

The proposal outlined in Treasury's "Green Book" explanation of tax policies would impose a reporting mandate for foreign digital asset accounts under Internal Revenue Code Section 6038D(b).

The Mandate Would Apply To Taxpayers Who Have

More Than $50,000 In Cryptocurrency,

Financial Accounts And Other Assets Held Overseas.

The proposal would cover any account housing digital assets maintained by a foreign digital asset exchange or asset service provider, and Treasury would be permitted to issue regulations expanding the scope of the accounts, according to the Green Book. The proposal would be effective for returns that have to be filed starting in 2023.

Section 6038D, created by the Foreign Account Tax Compliance Act, already requires reporting from anyone holding an interest in at least one specified foreign financial asset with a total value of at least $50,000, according to the Green Book. Treasury said in the Green Book that mandating people to specifically report offshore holdings of accounts with digital assets, subject to big penalties if they don't, is vital to curbing potential use of digital assets for tax avoidance.

"Tax Compliance And Enforcement With Respect To

Digital Assets Is A Rapidly Growing Problem,"

Treasury Said In The Green Book.

The Green Book also calls for increased reporting from financial institutions and digital asset brokers for purposes of exchanging information with foreign governments. Some financial institutions would have to report the account balance for all accounts housed at U.S. offices and held by foreign individuals, according to the Green Book.

Furthermore, if adopted and combined with existing law, the proposal would force brokers to report gross proceeds and other required details regarding sales of digital assets with respect to customers and substantial foreign owners in the case of some passive entities, the Green Book said.

That proposal would allow for the automatic exchange of information with other countries and provide Treasury with details on U.S. taxpayers who directly or through passive entities engage in digital asset transactions outside the country, according to the Green Book.

Treasury also wants to allow actively traded digital assets and derivatives or hedges of them to be marked to market if dealers or traders elect to under rules similar to those applying to actively traded commodities, the Green Book said.

The Green Book was released the same day President Joe Biden's administration released its budget proposal, which calls for raising the corporate tax rate to 28% and imposing a minimum tax rate of 20% on taxpayers whose incomes top $100 million.

The digital assets proposals in the Green Book together would raise about $11 billion, according to Treasury. In total, the Biden administration's budget is proposing $2.5 trillion in revenue increases.

Have a Virtual Currency Tax Problem?

Value Your Freedom?

Contact the Tax Lawyers at

Marini & Associates, P.A.

Read more at: Tax Times blog

.jpg)

.jpg)