According to Law360, A Maryland lawyer cannot be granted innocent spouse relief to avoid paying taxes on $227,000 of unreported income, partly because she should have known her husband was embezzling from a church where he was the finance director, the U.S. Tax Court said.

Kelli Hunter Reynolds had a duty to ask questions about additional checks from National City Christian Church that appeared in the couple's joint bank accounts in amounts similar to wages paid to her husband as part of his $95,000 salary, the court said. The couple didn't report those additional amounts for tax years 2004 to 2007, according to the opinion.

That Reynolds did not notice a discrepancy between the balances in their accounts and the amount they reported to the Internal Revenue Service, even though she spent money from the accounts and had legal training, disqualified her from claiming relief for not knowing about the underreporting, the Tax Court said.

U.S. Department Of Agriculture, Benefited From The

Additional And Unreported Income, The Tax Court Said.

Their Children And Owned Four Cars.

The Tax Court also rejected Reynolds' argument that she qualified for relief because she and her husband were separated and not living in the same household while he was in prison for embezzlement in 2013. The court said only a judicial decree of legal separation, which the couple did not obtain, would help qualify her for relief.

The Tax Court also rejected Reynolds' argument that paying the tax bill would create economic hardship, saying that it empathized with her as the sole breadwinner for a family of seven but that her reported monthly expenditures of $10,000 exceeded basic living expenses.

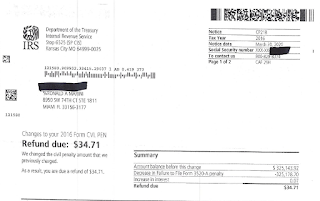

Have an IRS Tax Problem?

Contact the Tax Lawyers at

www.TaxAid.com or www.OVDPLaw.com

or Toll Free at 888 8TAXAID (888-882-9243)

Read more at: Tax Times blog