The Congressional Research Service has issued the Congressional Research Service-Issues in International Corporate Taxation: The 2017 Revision (P.L. 115-97) report that looks at how changes made in 2017 by the Tax Cuts and Jobs Act (TCJA, PL 115-97) to the international corporate tax rules addressed concerns under prior tax law and what problems, issues, and legal uncertainties arose under the TCJA.

The report is divided into three sections. The first section explains prior international tax rules and the revisions made in the TCJA. The second section discusses the four major issues of concern under prior law: allocation of investment; profit shifting; repatriation; and inversions. The second section also discusses how the TCJA addresses these concerns and raises new ones. It also discusses issues associated with international agreements. The third section summarizes commentary about problems and issues, including legal challenges and uncertainty, within the new international tax regime and options that have been suggested.

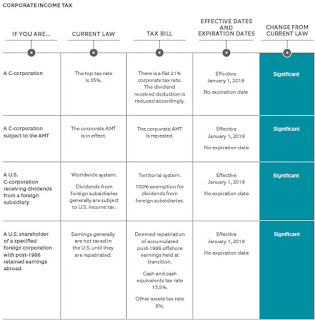

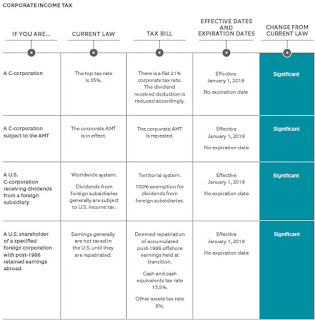

The report states that one of the major motivations for the TCJA was concern about the international tax system. Issues associated with these rules involved the allocation of investment between the US and other countries; the loss of revenue due to the artificial shifting of profit out of the US by multinational firms (both US and foreign); the penalties for repatriating income earned by foreign subsidiaries that led to the accumulation of deferred earnings abroad; and inversions (US firms shifting their headquarters to other countries for tax reasons). In addition to lowering the corporate tax rate from 35% to 21% and providing some other benefits for domestic investment (such as temporary expensing of equipment), the TCJA also substantially changed the international tax regime.

The TCJA moved the tax system from a nominal worldwide tax on all foreign-source income, with a credit against US tax for foreign taxes due, to a nominal territorial system that does not tax foreign-source income. Nevertheless, the report says, both systems could be considered a hybrid of a worldwide and territorial system. Prior law reduced the tax on foreign-source income by allowing deferral (taxing income of foreign subsidiaries only if it was repatriated or paid as a dividend to the US parent) and cross-crediting of foreign taxes (so the credit for high taxes paid in one country could offset US tax on income from a low-tax country). The new system exempts dividends but also imposes a current worldwide tax on global intangible low-taxed income (GILTI), but at a lower rate. It also introduces a corresponding lower rate on intangible income derived from abroad from assets in the US (foreign-derived intangible income, or FDII). The TCJA adds the base erosion and anti-abuse tax (BEAT) to existing anti-abuse measures aimed at artificial profit shifting. BEAT imposes a minimum tax on ordinary income plus certain payments to related foreign companies.

Despite the lower corporate tax rate, the report says it is not clear that capital will be shifted into the US from abroad; although a lower rate reduces the tax rate on equity-financed investments, it decreases the subsidy to debt-financed investments. Whether equity investments increase or decrease depends on the magnitude of the TCJA (which appear largely offsetting) and the international mobility of debt versus equity. It is also not clear whether the investment in stock will be allocated more efficiently or in a way more optimal for US welfare, although economic theory suggests that reducing the tax subsidy for debt is a clear improvement.

Although the TCJA's territorial tax may make profit shifting more attractive, overall, given other elements of the new system, the report says it appears to make profit shifting less important. GILTI and FDII bring the tax treatment of income from intangibles in the US and abroad closer together, and BEAT and stricter thin capitalization rules (rules limiting interest deductions) also limit profit shifting, including shifting through leveraging.

The TCJA ends most "penalties" for repatriating earnings and thus eliminates the prior incentives to retain earnings abroad. As part of ending these penalties, the TCJA also introduced a series of measures aimed at making inversions (a method of retaining earnings abroad where a corporation restructures itself so that the current parent is replaced by a foreign parent; thus moving its tax residence to the foreign country) less attractive.

The report says some TCJA measures may violate international agreements such as the World Trade Organization (WTO), bilateral tax treaties, and Organization for Economic Cooperation and Development (OECD) minimum standards to prevent harmful tax practices.

Have an International Tax Problem?

Contact the Tax Lawyers at

Marini& Associates, P.A.

for a FREE Tax Consultation

Toll Free at 888-8TaxAid (888) 882-9243